Navigating The Unpredictable: Gas Price Trends In 2025

Navigating the Unpredictable: Gas Price Trends in 2025

The price of gasoline, a volatile commodity shaped by a complex interplay of global events, economic forces, and technological advancements, remains a constant source of concern for consumers worldwide. As we look towards 2025, navigating the future of gas prices requires understanding the key drivers influencing this crucial market.

This article delves into the complex landscape of gas price trends, examining the potential factors that could shape prices in 2025. We will explore the interplay of global oil production, demand dynamics, geopolitical tensions, technological innovations, and government policies to paint a comprehensive picture of the potential trajectory of gas prices.

The Global Oil Landscape: Supply and Demand Dynamics

The foundation of gas price trends lies in the global oil market. The delicate balance between supply and demand dictates the price of crude oil, which directly impacts the cost of gasoline.

Supply-Side Challenges:

- OPEC+ Production: The Organization of the Petroleum Exporting Countries (OPEC) and its allies, collectively known as OPEC+, play a pivotal role in global oil supply. Their decisions on production quotas significantly impact global oil prices. While OPEC+ has shown a willingness to adjust production levels to stabilize prices, geopolitical tensions and internal disagreements could lead to supply disruptions.

- Investment in New Oil Fields: The global energy transition towards renewable energy sources has led to a decline in investment in new oil fields. This could create a supply gap in the future, potentially pushing prices higher.

- Technological Advancements in Oil Extraction: Technological advancements in oil extraction, such as hydraulic fracturing and horizontal drilling, have increased production in recent years. However, these technologies face environmental concerns and regulatory hurdles, potentially limiting their long-term impact.

- Climate Change Impacts: Climate change impacts, such as extreme weather events and rising sea levels, could disrupt oil production and transportation, further influencing supply dynamics.

Demand-Side Drivers:

- Economic Growth: Global economic growth plays a crucial role in driving oil demand. A robust global economy typically leads to increased energy consumption, boosting demand for oil and pushing prices higher. Conversely, economic downturns can suppress demand and lower prices.

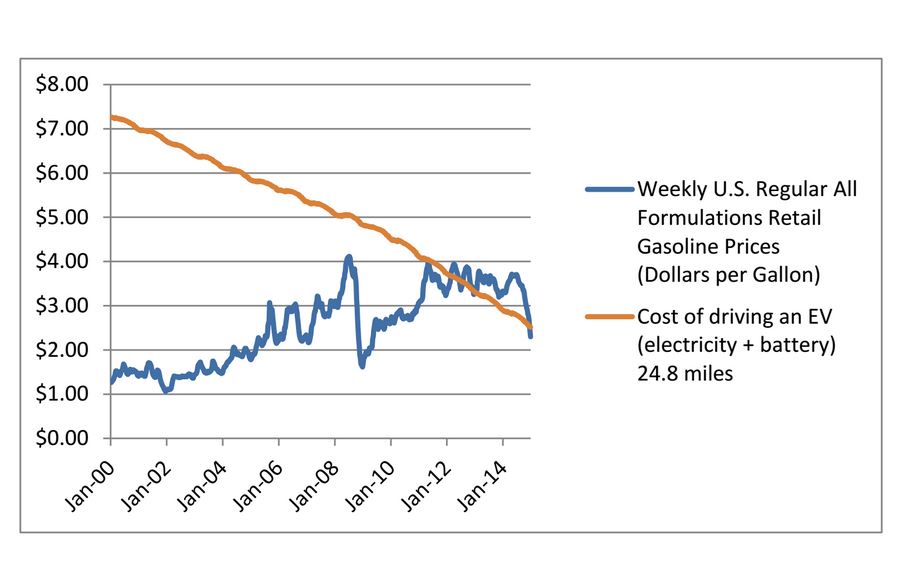

- Transportation Sector: The transportation sector remains the largest consumer of oil globally. The adoption of electric vehicles (EVs) and other alternative transportation technologies could significantly reduce oil demand in the future. However, the transition to EVs is expected to be gradual, with internal combustion engines likely to remain dominant in the short term.

- Emerging Markets: Rapid economic growth in emerging markets, particularly in Asia, is driving a surge in oil demand. As these economies continue to develop, their energy consumption is likely to rise, putting upward pressure on oil prices.

- Government Policies: Government policies, such as fuel efficiency standards and carbon taxes, can influence oil demand. Policies promoting renewable energy sources and energy efficiency can reduce oil consumption, while policies supporting fossil fuels can increase demand.

Geopolitical Tensions: A Volatile Factor

Geopolitical tensions and conflicts can significantly disrupt oil markets, leading to price volatility.

- Middle East Instability: The Middle East, home to a significant portion of the world’s oil reserves, remains a volatile region. Political instability, conflicts, and sanctions can disrupt oil production and transportation, leading to price spikes.

- US-China Relations: The complex relationship between the US and China, two of the world’s largest economies, can impact oil prices. Tensions between these countries could lead to disruptions in oil trade and investment, impacting prices.

- Russia-Ukraine Conflict: The ongoing conflict between Russia and Ukraine has significantly disrupted global energy markets. Russia’s role as a major oil and gas exporter has been thrown into question, leading to uncertainty and price volatility.

Technological Innovations: A Balancing Force

Technological advancements in the energy sector are playing a crucial role in shaping the future of gas prices.

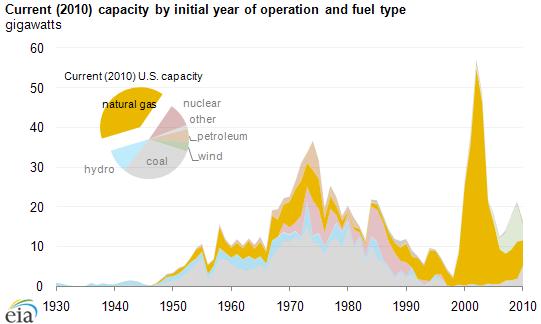

- Renewable Energy Sources: The rapid development of renewable energy sources, such as solar, wind, and hydro power, is creating a significant shift in the energy landscape. As these technologies become more cost-effective, they are expected to displace fossil fuels, potentially reducing demand for oil and lowering gas prices.

- Electric Vehicles: The growing popularity of electric vehicles (EVs) is reducing demand for gasoline. As EV adoption accelerates, the impact on gas prices is likely to become more pronounced.

- Biofuels: Biofuels, derived from plant materials, offer a potential alternative to gasoline. However, their production faces challenges related to land use, sustainability, and cost.

Government Policies: Shaping the Future

Government policies play a significant role in influencing gas prices by impacting supply, demand, and investment decisions.

- Fuel Efficiency Standards: Governments around the world are implementing fuel efficiency standards for vehicles, aiming to reduce fuel consumption and lower emissions. These regulations can impact the demand for gasoline.

- Carbon Taxes: Carbon taxes are designed to discourage the use of fossil fuels by imposing a cost on carbon emissions. These taxes can increase the cost of gasoline, encouraging consumers to switch to alternative fuels.

- Subsidies: Governments often provide subsidies for fossil fuels, making them more affordable for consumers. However, these subsidies can distort market signals and hinder the development of renewable energy sources.

- Investment in Renewable Energy: Governments are increasingly investing in renewable energy infrastructure and research and development. These investments can accelerate the transition to a low-carbon economy, potentially reducing demand for oil and lowering gas prices.

Scenarios for Gas Prices in 2025

Given the complex interplay of factors influencing gas prices, predicting their trajectory with certainty is challenging. However, we can explore different scenarios based on the potential evolution of key drivers:

Scenario 1: High Gas Prices

- Factors: Persistent geopolitical tensions, limited investment in new oil fields, strong global economic growth, and slow adoption of EVs.

- Outlook: Gas prices could remain elevated or even increase further, putting pressure on consumers and businesses.

Scenario 2: Moderate Gas Prices

- Factors: Stable geopolitical environment, moderate economic growth, gradual increase in EV adoption, and government policies promoting energy efficiency and renewable energy.

- Outlook: Gas prices could stabilize at current levels or fluctuate within a relatively narrow range.

Scenario 3: Lower Gas Prices

- Factors: Declining global oil demand due to rapid EV adoption, significant investment in renewable energy, and a shift away from fossil fuels.

- Outlook: Gas prices could decline significantly as alternative energy sources gain prominence.

Conclusion: Navigating the Uncertainties

Predicting gas prices in 2025 is a complex task, with numerous factors playing a role. The future trajectory of gas prices will depend on the interplay of global oil production, demand dynamics, geopolitical tensions, technological innovations, and government policies.

While the exact price levels remain uncertain, understanding the key drivers influencing the market is essential for navigating the potential fluctuations. As we move towards a more sustainable energy future, the transition to renewable energy sources and electric vehicles will likely play a significant role in shaping the demand for gasoline and influencing its price.

Looking ahead, it is crucial to remain informed about the evolving energy landscape, monitor key trends, and adapt to the changing dynamics of the global oil market.