Navigating The Uncharted Waters: Stock Market Trends In 2025

Navigating the Uncharted Waters: Stock Market Trends in 2025

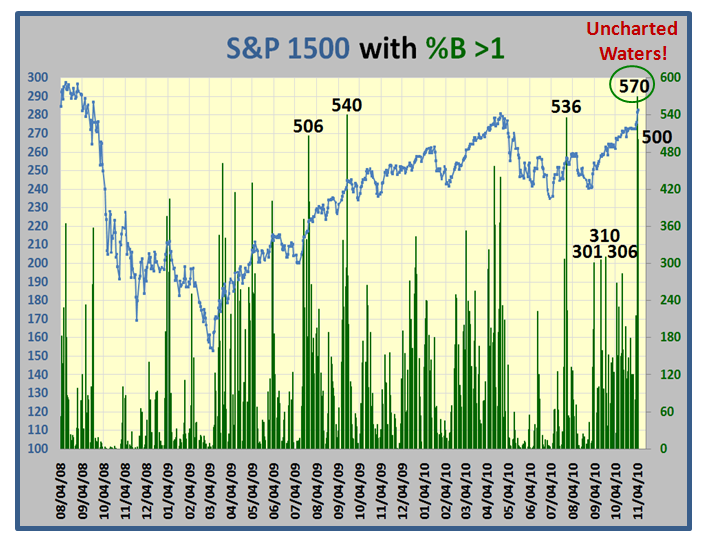

The stock market, a complex and often unpredictable beast, is perpetually in flux. As we navigate the turbulent waters of 2023, peering into the future of 2025 seems a daunting task. Yet, understanding the forces shaping the market today can provide valuable insights into potential trends that might dominate the next few years. This article will delve into the key factors influencing stock market trends in 2025, exploring potential opportunities and risks, and offering guidance for investors.

The Macroeconomic Landscape: A Foundation for Future Trends

The global economy is a tapestry woven from diverse threads, each contributing to the overall picture. In 2025, several macroeconomic factors will likely shape the stock market landscape:

-

Inflation and Interest Rates: Inflation, a persistent concern in recent years, will continue to play a pivotal role. Central banks worldwide are grappling with managing inflation, and their actions will significantly impact interest rates. Higher interest rates can dampen economic growth and reduce corporate profits, potentially leading to stock market volatility. However, if inflation cools down and interest rates stabilize, it could create a more favorable environment for stock market growth.

-

Geopolitical Tensions: The ongoing geopolitical landscape, marked by global conflicts and trade tensions, will continue to influence market sentiment. Uncertainty surrounding international relations can lead to investor anxiety and market fluctuations. However, potential de-escalation or resolution of geopolitical conflicts could positively impact the stock market.

-

Technological Advancements: Technology continues to be a transformative force, driving innovation and economic growth. The rise of artificial intelligence (AI), automation, and other emerging technologies will likely create new industries and disrupt existing ones. Investors will need to carefully assess the impact of these advancements on specific sectors and companies.

-

Climate Change and Sustainability: Growing awareness of climate change and its impact is driving a shift towards sustainable investments. Companies with strong environmental, social, and governance (ESG) practices are becoming increasingly attractive to investors. This trend will likely intensify in 2025, influencing investment decisions across sectors.

Sectoral Shifts: Identifying Growth Opportunities

While the macroeconomic environment provides a broad backdrop, specific sectors within the stock market will experience unique trends:

-

Technology: The technology sector remains a focal point for innovation and growth. Artificial intelligence (AI), cloud computing, cybersecurity, and the metaverse are expected to continue driving growth in 2025. However, valuations in the tech sector have come under scrutiny, and investors will need to carefully assess individual companies and their potential for long-term growth.

-

Healthcare: The healthcare sector is a perennial growth driver, driven by an aging population and advancements in medical technology. Pharmaceuticals, biotechnology, and medical devices are expected to continue to see strong demand in 2025. However, regulatory challenges and rising healthcare costs could pose some risks.

-

Renewable Energy: The transition towards a greener economy is accelerating, creating significant opportunities in the renewable energy sector. Solar, wind, and other renewable energy technologies are expected to see continued growth in 2025, driven by government policies and increasing investor interest.

-

Consumer Discretionary: The consumer discretionary sector, encompassing retail, travel, and entertainment, will be influenced by consumer spending patterns. As economies recover from the pandemic and inflation eases, consumer spending could rebound, benefiting companies in this sector. However, rising interest rates and concerns about economic slowdowns could dampen consumer confidence.

Navigating the Risks: Understanding Potential Headwinds

While opportunities abound, investors must also be aware of potential risks that could impact the stock market in 2025:

-

Recession Fears: Concerns about a global recession are persistent. Rising interest rates, inflation, and geopolitical tensions could lead to economic slowdowns, impacting corporate profits and stock market valuations.

-

Inflationary Pressures: Persistent inflation could continue to erode corporate margins and consumer spending power. Companies may struggle to pass on rising costs to consumers, leading to profit squeezes.

-

Geopolitical Uncertainty: The ongoing geopolitical landscape remains volatile, with potential for disruptions to global trade and supply chains. This uncertainty can create market volatility and impact investment decisions.

-

Valuation Concerns: Stock market valuations have been elevated in recent years. As interest rates rise, the value of future earnings is discounted more heavily, potentially leading to a correction in stock prices.

Investment Strategies for 2025: Adapting to the Changing Landscape

Navigating the stock market in 2025 will require a strategic approach that considers both potential opportunities and risks:

-

Diversification: Spread investments across different asset classes, sectors, and geographies to mitigate risk. A diversified portfolio can help weather market fluctuations and potentially enhance returns.

-

Long-Term Perspective: Avoid short-term market timing and focus on investing for the long term. Market cycles are inevitable, and patience is key to achieving long-term investment goals.

-

Value Investing: Seek out undervalued companies with strong fundamentals and potential for long-term growth. This approach can provide resilience in volatile markets and potentially generate outsized returns.

-

ESG Investing: Consider investing in companies with strong ESG practices, aligning investments with personal values and contributing to a more sustainable future.

-

Active Management: Seek guidance from experienced investment professionals who can help navigate market complexities and make informed investment decisions.

Conclusion: Embracing the Future with Informed Decisions

The stock market in 2025 will be shaped by a complex interplay of economic, technological, and geopolitical forces. While uncertainty remains, understanding the key trends and potential risks can empower investors to make informed decisions. By embracing a long-term perspective, diversifying portfolios, and seeking out value and sustainability, investors can position themselves to navigate the uncharted waters of the future and potentially achieve their financial goals. The stock market, like life itself, is a journey of constant learning and adaptation. Those who embrace this journey with knowledge, discipline, and a long-term mindset are best positioned to thrive in the ever-evolving world of investing.