Navigating The Uncharted Waters: Mortgage Rate Trends In 2025

Navigating the Uncharted Waters: Mortgage Rate Trends in 2025

The housing market, a dynamic and ever-evolving landscape, is intricately tied to the ebb and flow of mortgage rates. These rates, the cost of borrowing money to purchase a home, have a profound impact on affordability, demand, and overall market activity. As we venture into 2025, predicting mortgage rate trends becomes a crucial endeavor for both prospective homebuyers and seasoned investors.

The Recent Rollercoaster Ride:

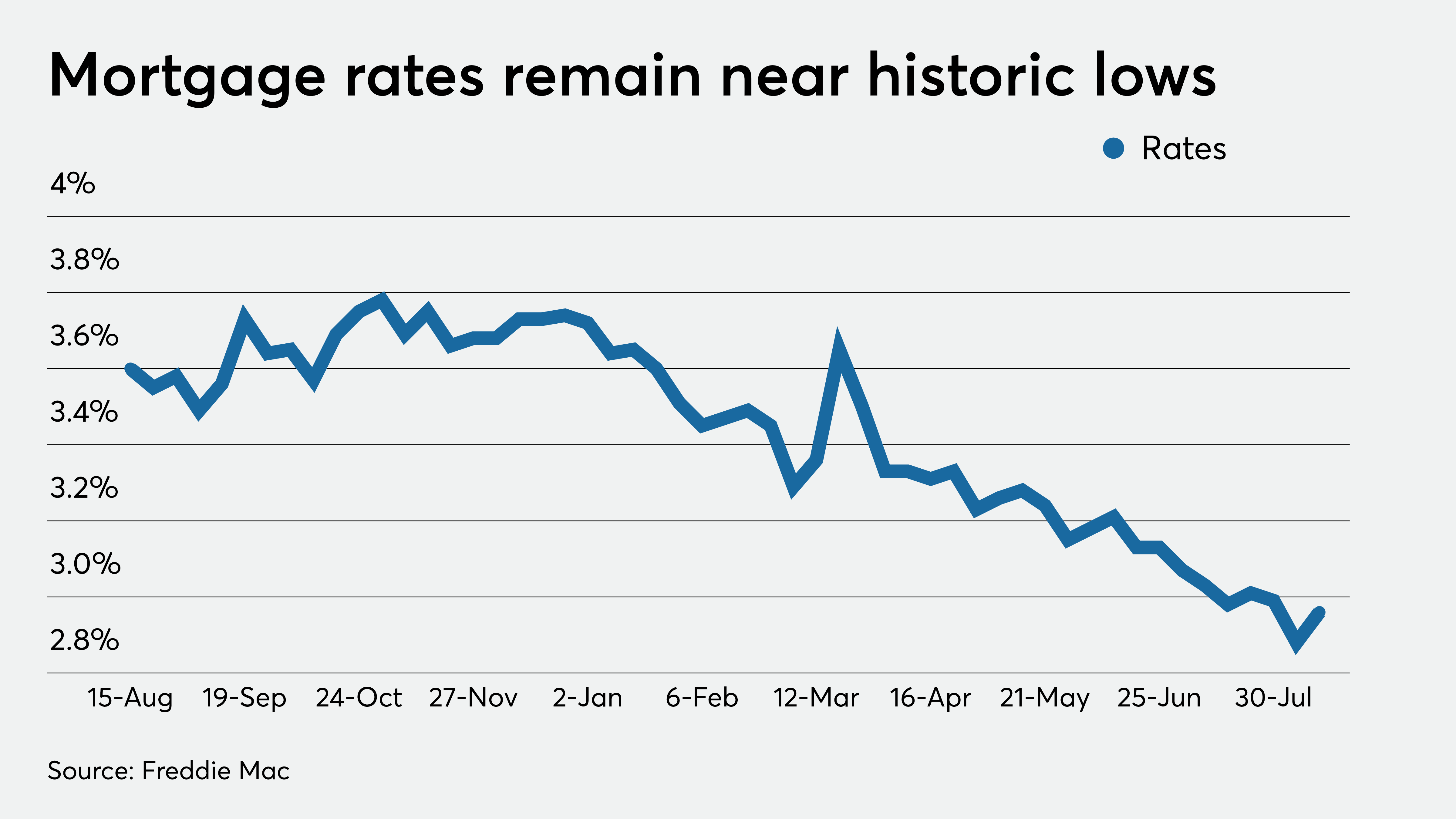

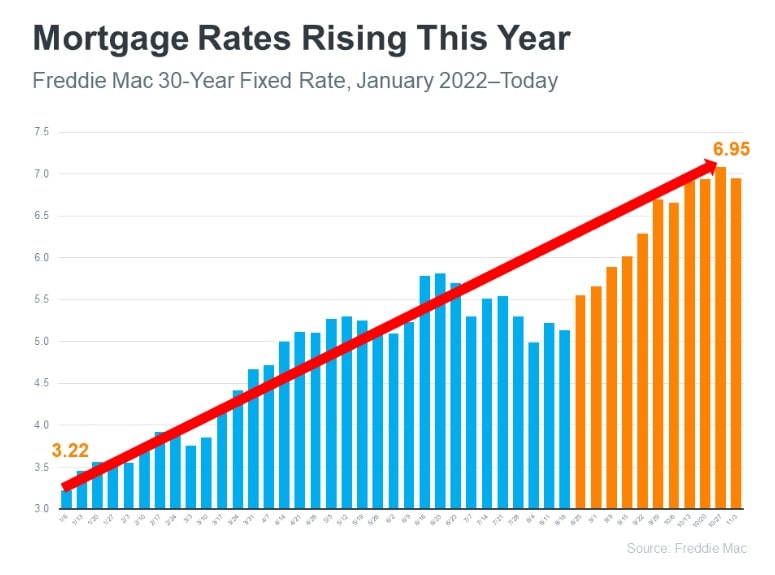

The year 2023 witnessed a significant shift in the mortgage landscape. After a period of historically low rates fueled by pandemic-era stimulus, the Federal Reserve embarked on an aggressive tightening cycle, pushing interest rates upward. This move aimed to combat inflation, but it inadvertently cooled down the housing market. Consequently, mortgage rates climbed to their highest levels in decades, making homeownership more expensive for many.

Factors Shaping the 2025 Landscape:

Forecasting mortgage rates for 2025 requires considering a complex interplay of economic indicators, policy decisions, and global events. Here are some key factors that will influence the trajectory of mortgage rates:

1. Inflation and the Federal Reserve:

The Federal Reserve’s battle against inflation remains central to the economic outlook. If inflation continues to subside, the Fed might pivot towards a more accommodative monetary policy, potentially leading to lower interest rates in 2025. However, if inflation proves persistent, the Fed might need to maintain or even increase interest rates, keeping mortgage rates elevated.

2. Economic Growth and Job Market:

The health of the overall economy is closely linked to mortgage rates. Strong economic growth and a robust job market generally support lower mortgage rates. Conversely, a weakening economy or rising unemployment could lead to increased risk aversion among lenders, potentially pushing rates higher.

3. Government Policies:

Government policies, particularly those related to housing finance, can influence mortgage rates. Changes in regulations, subsidies, or tax incentives can affect the cost of borrowing and influence mortgage demand.

4. Global Events:

Geopolitical tensions, global trade disputes, and international financial crises can significantly impact mortgage rates. These events often create uncertainty in the market, leading to increased risk aversion and potentially higher interest rates.

5. Supply and Demand Dynamics:

The balance between housing supply and demand plays a crucial role in mortgage rate trends. A shortage of homes for sale can push prices higher, making borrowing more attractive for lenders and potentially leading to lower mortgage rates. Conversely, an oversupply of homes can lead to price declines, making borrowing less appealing for lenders and potentially driving rates higher.

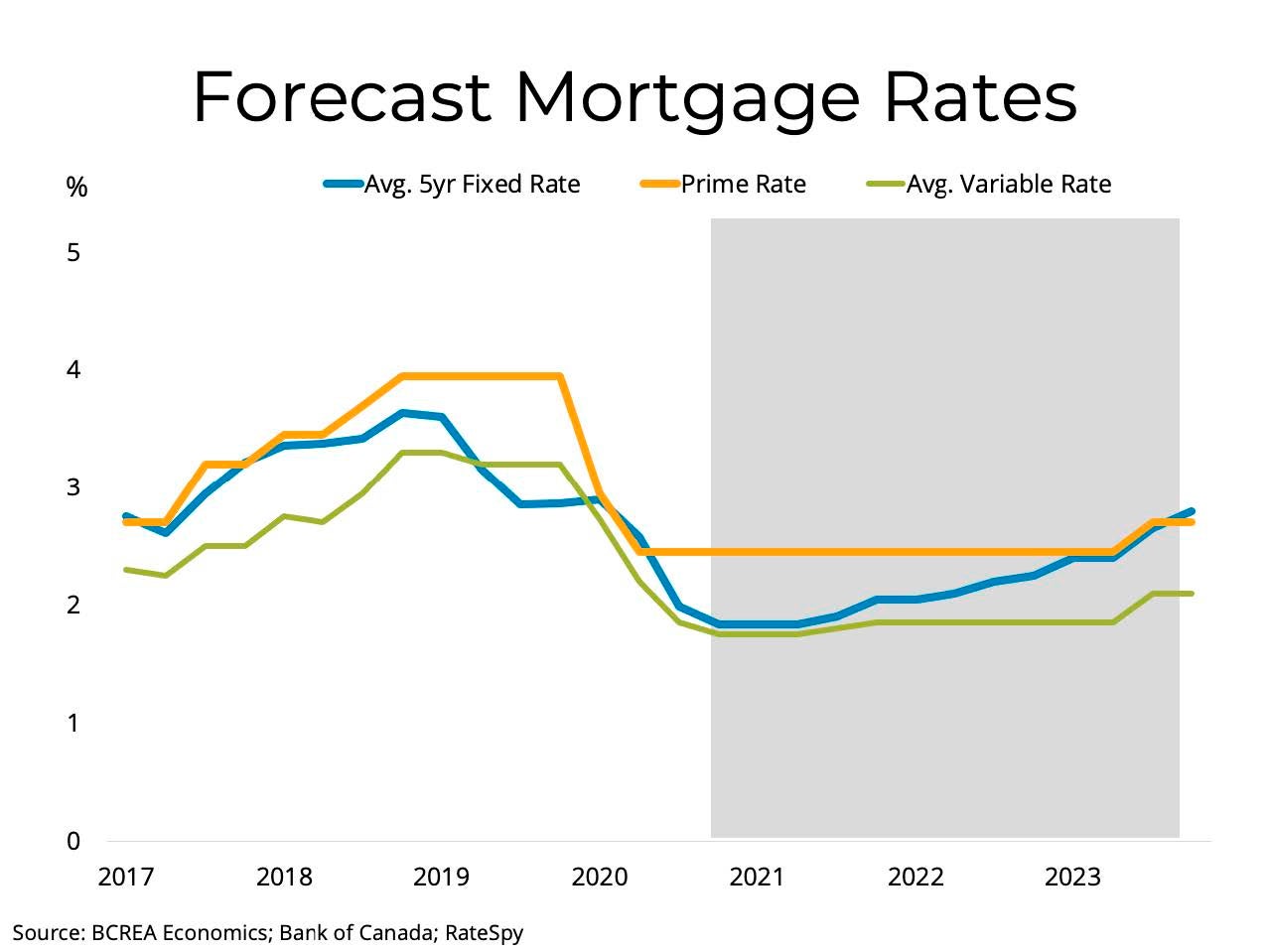

Scenarios for 2025:

Given the complex interplay of these factors, several scenarios could unfold in 2025:

Scenario 1: Stable Rates with Moderate Growth:

This scenario envisions a gradual moderation of inflation and a continued, albeit slower, economic growth. The Fed might maintain a cautious approach, gradually reducing interest rates, leading to a stable mortgage rate environment with moderate increases.

Scenario 2: Rising Rates Due to Persistent Inflation:

If inflation proves more stubborn than anticipated, the Fed might need to keep interest rates elevated for longer. This could lead to continued upward pressure on mortgage rates, potentially reaching new highs in 2025.

Scenario 3: Lower Rates Driven by Economic Slowdown:

A significant economic slowdown or recession could prompt the Fed to aggressively cut interest rates to stimulate growth. This could lead to a sharp decline in mortgage rates, potentially reaching levels not seen in recent years.

Implications for Homebuyers and Investors:

The trajectory of mortgage rates in 2025 will have significant implications for both prospective homebuyers and real estate investors:

For Homebuyers:

- Higher Rates: Rising mortgage rates will make homeownership more expensive, potentially putting a strain on affordability and reducing purchasing power.

- Lower Rates: Falling mortgage rates will make homeownership more accessible, potentially boosting demand and driving up home prices.

- Strategic Planning: Understanding the potential mortgage rate environment is crucial for homebuyers. It’s essential to consider the long-term affordability of a mortgage and factor in potential rate changes.

For Investors:

- Higher Rates: Rising mortgage rates can reduce demand for rental properties, potentially impacting rental income and property values.

- Lower Rates: Falling mortgage rates can boost demand for rental properties, potentially driving up rental income and property values.

- Investment Strategies: Real estate investors need to carefully assess the impact of mortgage rate changes on their investment strategies, considering both short-term and long-term implications.

Navigating Uncertainty:

Predicting mortgage rate trends with absolute certainty is impossible. However, by understanding the key factors influencing rates, homebuyers and investors can make more informed decisions and navigate the evolving market landscape.

Tips for Homebuyers:

- Monitor Economic Indicators: Stay informed about inflation, economic growth, and the Federal Reserve’s policy decisions.

- Seek Pre-Approval: Get pre-approved for a mortgage to understand your borrowing capacity and prepare for potential rate fluctuations.

- Consider Fixed-Rate Mortgages: Locking in a fixed interest rate can provide stability and protect against future rate increases.

- Explore Adjustable-Rate Mortgages (ARMs): ARMs can offer lower initial rates, but they come with the risk of higher rates in the future.

Tips for Investors:

- Analyze Market Trends: Monitor housing market dynamics, rental demand, and potential changes in government policies.

- Diversify Investments: Spread your investments across different asset classes to mitigate risk.

- Consider Long-Term Investment Horizons: Focus on long-term value creation and be prepared for market fluctuations.

- Consult with Financial Experts: Seek advice from experienced real estate professionals and financial advisors to make informed investment decisions.

Conclusion:

The mortgage rate landscape in 2025 remains shrouded in uncertainty. However, by carefully analyzing the economic factors, policy decisions, and global events that influence rates, homebuyers and investors can make more informed decisions and navigate the evolving market dynamics. Understanding the potential scenarios and adapting strategies accordingly is crucial for success in this ever-changing environment.