Navigating The Uncharted Waters: Mortgage Rate Trends 2025-2026

Navigating the Uncharted Waters: Mortgage Rate Trends 2025-2026

The housing market, a cornerstone of economic stability and personal wealth, is intrinsically linked to mortgage rates. As we navigate the turbulent waters of 2025-2026, predicting these rates becomes a crucial exercise for both homeowners and prospective buyers. This article delves into the key factors influencing mortgage rates over the next two years, providing insights into potential trends and their implications.

The Macroeconomic Landscape: A Complex Tapestry

The global economy is currently grappling with a confluence of challenges, from persistent inflation and geopolitical tensions to supply chain disruptions and the lingering effects of the pandemic. These factors exert a significant influence on mortgage rates, making accurate predictions an intricate task.

1. The Federal Reserve’s Tightrope Walk:

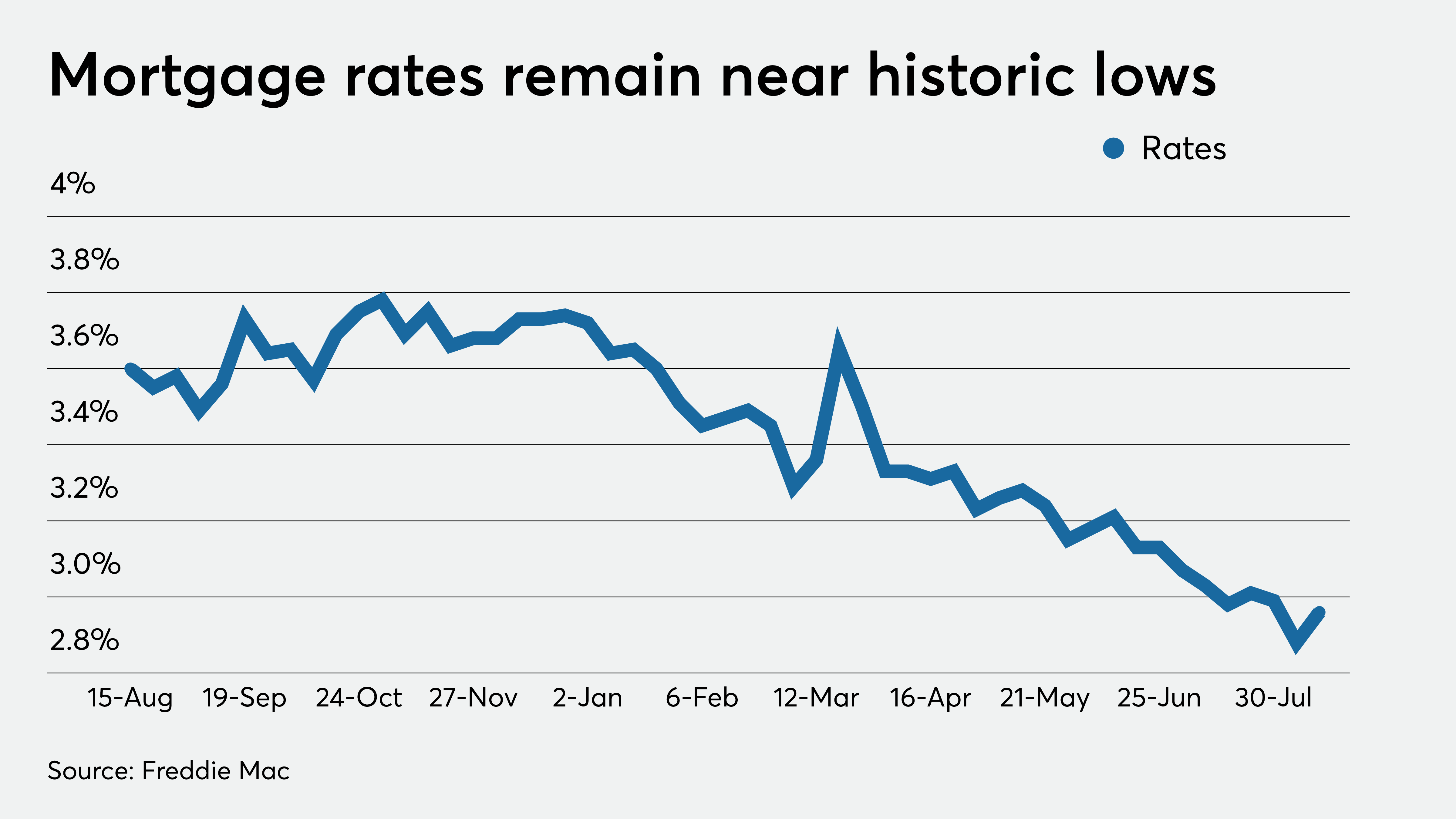

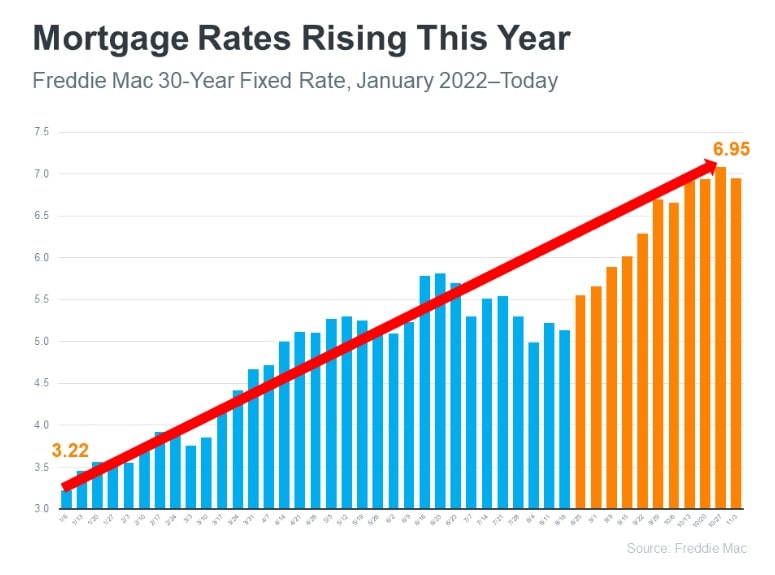

The Federal Reserve (Fed), the central bank of the United States, plays a pivotal role in setting interest rates. Its primary objective is to maintain price stability and full employment. In recent months, the Fed has aggressively raised interest rates to combat inflation. This tightening of monetary policy has directly impacted mortgage rates, pushing them to their highest levels in decades.

2. Inflation: A Persistent Threat:

Inflation, the rate at which prices rise, has been a major concern for consumers and policymakers alike. While recent data suggests a cooling of inflation, it remains stubbornly high, forcing the Fed to maintain its hawkish stance. Elevated inflation increases the likelihood of further interest rate hikes, potentially pushing mortgage rates even higher in the coming months.

3. Geopolitical Uncertainty: A Shadow Over the Market:

The ongoing conflict in Ukraine, coupled with escalating tensions between the United States and China, has injected significant uncertainty into the global economy. These geopolitical events can trigger market volatility and affect investor sentiment, potentially leading to fluctuations in mortgage rates.

4. The Labor Market: A Double-Edged Sword:

A robust labor market, with low unemployment and strong wage growth, can fuel economic growth and support housing demand. However, this also puts upward pressure on inflation, potentially prompting the Fed to raise interest rates further. The delicate balance between these forces will significantly impact mortgage rate trends.

Forecasting the Future: A Balancing Act of Variables

Given the complex interplay of factors, predicting mortgage rates with absolute certainty is impossible. However, by analyzing current trends and potential scenarios, we can gain valuable insights into potential trajectories.

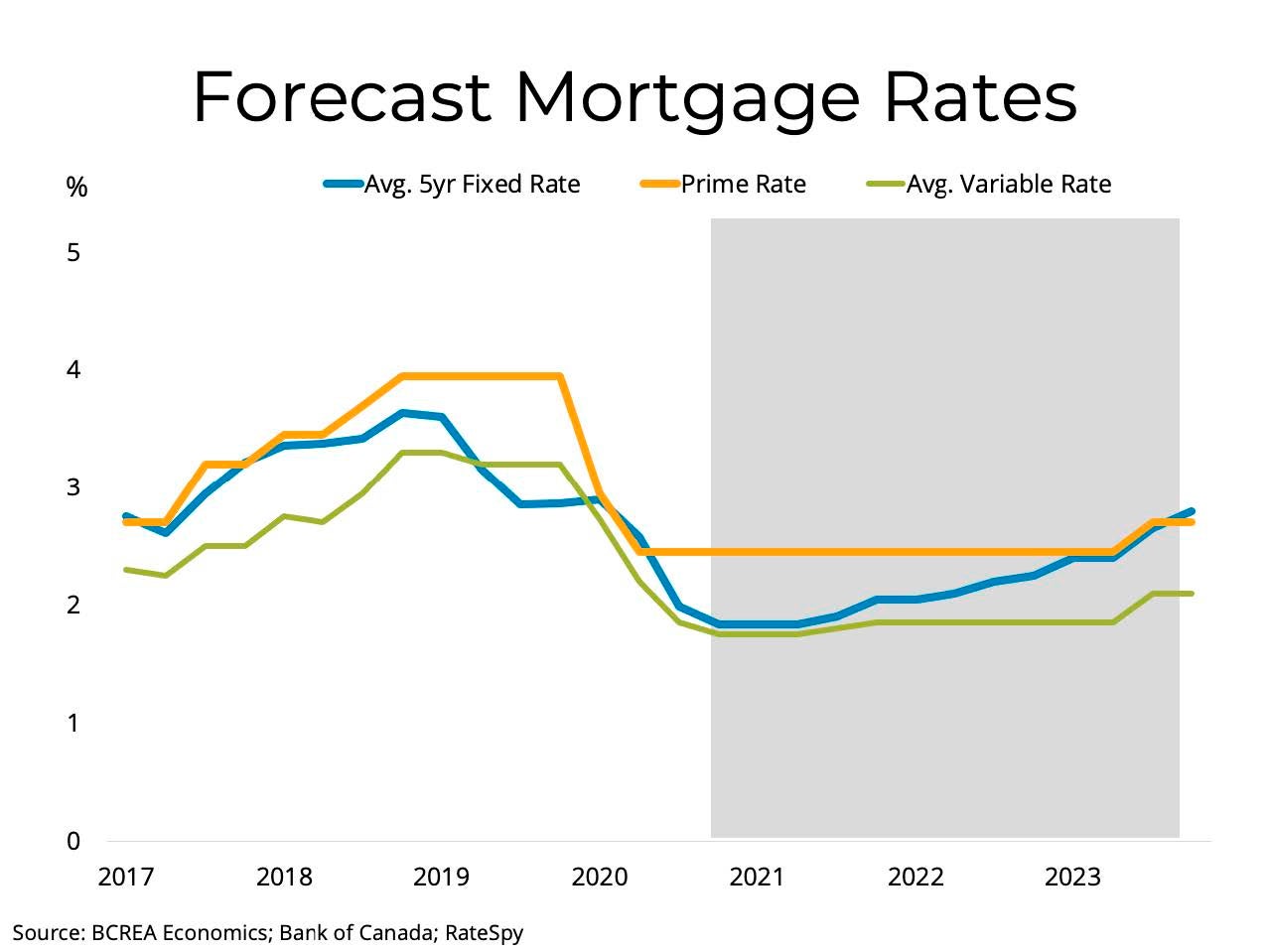

1. Optimistic Scenario: A Gradual Descent:

If inflation cools down more rapidly than anticipated, allowing the Fed to ease its monetary policy, mortgage rates could begin to decline in the latter half of 2025. This scenario assumes a resolution of geopolitical tensions and a gradual normalization of supply chains, leading to a more stable economic environment.

2. Cautious Scenario: A Plateau with Potential Volatility:

If inflation remains elevated, the Fed may continue to raise interest rates, keeping mortgage rates near current levels or even pushing them higher in the short term. This scenario suggests a period of consolidation, with potential volatility driven by economic data releases and geopolitical events.

3. Pessimistic Scenario: A Persistent Uptrend:

If inflation proves more persistent, forcing the Fed to maintain aggressive rate hikes, mortgage rates could continue to rise in 2025 and 2026. This scenario is particularly concerning for prospective homebuyers, as it would significantly increase borrowing costs and potentially dampen housing demand.

Implications for Homeowners and Buyers:

The direction of mortgage rates has significant implications for both homeowners and prospective buyers:

For Homeowners:

- Rising Rates: Higher rates could make refinancing less attractive, as the savings from a lower rate might not offset the closing costs.

- Falling Rates: A decline in rates could present an opportunity to refinance existing mortgages, potentially lowering monthly payments.

For Prospective Buyers:

- Rising Rates: Higher rates increase the cost of borrowing, making homeownership less affordable and potentially slowing down demand.

- Falling Rates: Lower rates make mortgages more accessible, potentially boosting demand and driving up home prices.

Navigating the Unpredictable:

The next two years promise to be a period of significant uncertainty in the housing market. While predicting mortgage rate trends with absolute accuracy is challenging, understanding the key drivers and potential scenarios can help homeowners and buyers make informed decisions.

1. Stay Informed: Continuously monitor economic data releases, Fed statements, and market commentary to stay informed about potential shifts in mortgage rate trends.

2. Consider Your Individual Circumstances: Evaluate your financial situation, including your income, debt levels, and savings, to determine your affordability and risk tolerance.

3. Seek Professional Advice: Consult with a mortgage lender or financial advisor to discuss your specific needs and explore various mortgage options.

4. Be Prepared for Flexibility: The housing market is dynamic, and it is essential to be adaptable to changing conditions. Be prepared to adjust your plans based on evolving market trends.

Conclusion:

The future of mortgage rates remains shrouded in uncertainty, influenced by a complex interplay of macroeconomic factors. While the next two years may present challenges, understanding the key drivers and potential scenarios empowers homeowners and buyers to navigate this dynamic market with confidence and make informed decisions that align with their financial goals. By staying informed, seeking professional advice, and remaining adaptable, individuals can position themselves to thrive in the ever-evolving landscape of mortgage rates.