Navigating The Uncharted Waters: Mortgage Interest Rate Trends In 2025

Navigating the Uncharted Waters: Mortgage Interest Rate Trends in 2025

The housing market is a dynamic beast, constantly evolving with the ebb and flow of economic forces. One of the most significant drivers of this evolution is the ever-changing landscape of mortgage interest rates. As we stand on the cusp of 2025, it’s crucial to understand the potential trends that will shape the mortgage market and impact homeowners and aspiring buyers alike.

A Look Back: The Rollercoaster Ride of Recent Years

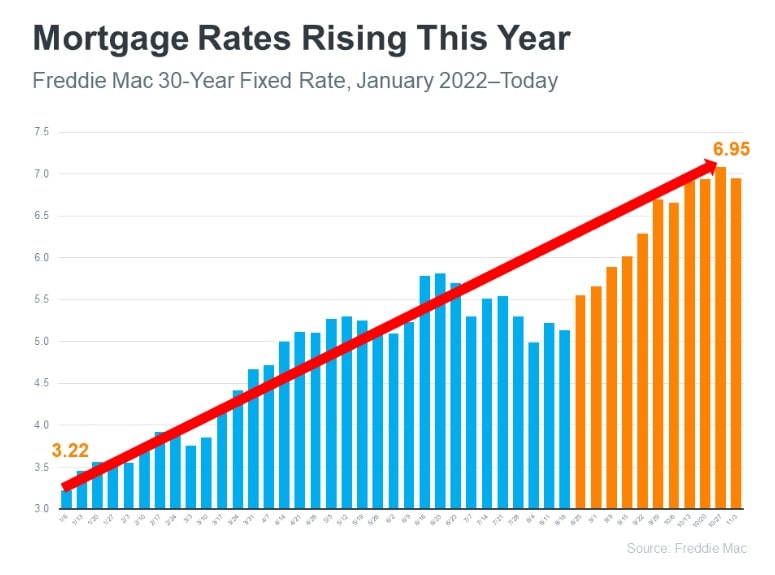

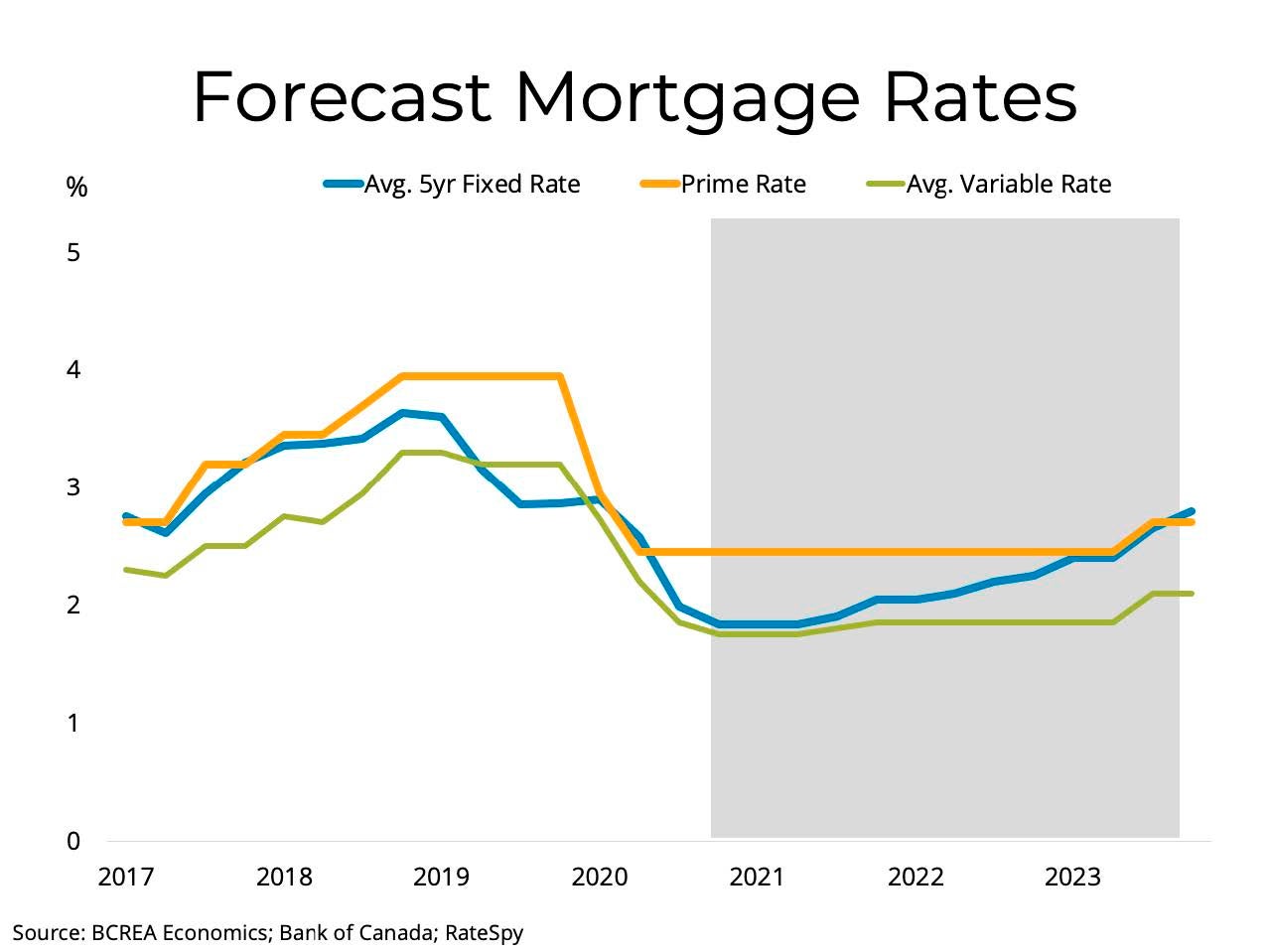

The past few years have witnessed a dramatic shift in mortgage interest rates. The pandemic-induced economic turmoil led to historically low rates, making homeownership more accessible than ever. However, this period of affordability was short-lived, as the Federal Reserve embarked on an aggressive rate hike cycle to combat inflation. This resulted in a sharp rise in mortgage rates, pushing affordability back into the realm of a distant dream for many.

Forecasting the Future: Key Factors Shaping 2025

Predicting the future of mortgage interest rates is a complex task, influenced by a multitude of factors. However, by analyzing current trends and economic indicators, we can glean insights into potential scenarios for 2025.

1. The Federal Reserve’s Monetary Policy:

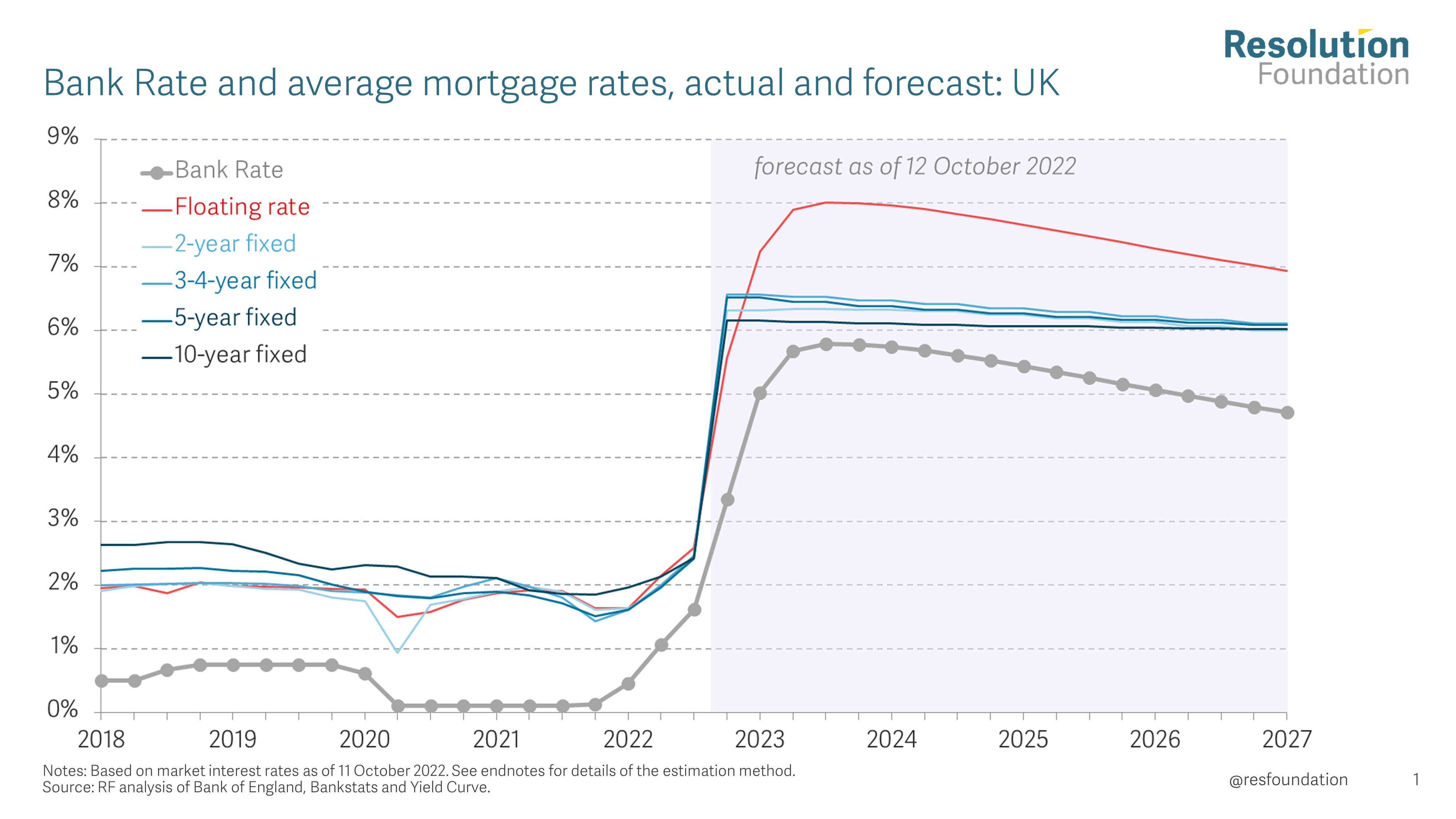

The Federal Reserve plays a pivotal role in setting the tone for interest rates. Its actions, driven by inflation and economic growth targets, have a direct impact on borrowing costs. While the Fed has signaled a potential pause in rate hikes, the path forward remains uncertain.

- Scenario 1: Continued Rate Hikes: If inflation proves persistent and the Fed continues its aggressive tightening stance, mortgage rates could remain elevated or even climb further in 2025. This scenario would present significant challenges for affordability and potentially dampen housing market activity.

- Scenario 2: Rate Stabilization: If inflation cools down and the Fed achieves its desired level of economic stability, rates could stabilize in 2025. This scenario would provide some relief for borrowers, but the overall impact on affordability would depend on the starting point for rates.

- Scenario 3: Rate Cuts: While unlikely in the short term, a scenario where the Fed pivots to rate cuts could occur if economic growth weakens significantly. This would lead to a decline in mortgage rates, boosting affordability and potentially reigniting housing market demand.

2. Inflation and Economic Growth:

The interplay between inflation and economic growth is a key driver of interest rate movements.

- High Inflation: Persistent high inflation forces the Fed to raise rates to curb price increases, pushing mortgage rates higher.

- Weak Economic Growth: A sluggish economy could lead to lower inflation and a potential easing of monetary policy, potentially pushing rates down.

3. Global Economic Conditions:

The global economy is interconnected, and events outside the U.S. can influence domestic interest rates.

- Geopolitical Tensions: Conflicts and geopolitical instability can create economic uncertainty and volatility, affecting investor sentiment and potentially leading to higher interest rates.

- Global Monetary Policy: The actions of central banks in other major economies can influence the direction of U.S. interest rates.

4. Housing Market Dynamics:

The health of the housing market itself can impact mortgage interest rates.

- Strong Demand: Robust housing demand can push rates higher as lenders compete for borrowers.

- Weak Demand: A cooling housing market can lead to lower rates as lenders seek to attract borrowers.

5. Technological Advancements:

Technological advancements are reshaping the mortgage industry, with potential implications for interest rates.

- Fintech Innovations: The rise of fintech companies is bringing greater efficiency and transparency to the mortgage process, potentially leading to lower borrowing costs.

- AI-Powered Lending: Artificial intelligence is being used to automate lending decisions, potentially leading to faster approvals and more competitive rates.

Potential Scenarios for 2025

Based on the factors discussed above, here are some potential scenarios for mortgage interest rates in 2025:

Scenario 1: Continued Rate Hikes (High Inflation, Strong Economy):

- Average 30-year fixed-rate mortgage: 7-8%

- Impact: Affordability remains a significant challenge, limiting homeownership opportunities for many. Housing market activity could slow down.

Scenario 2: Rate Stabilization (Moderate Inflation, Steady Economic Growth):

- Average 30-year fixed-rate mortgage: 6-7%

- Impact: Rates remain elevated but stabilize, providing some relief for borrowers. Housing market activity could be stable or see modest growth.

Scenario 3: Rate Cuts (Low Inflation, Weak Economic Growth):

- Average 30-year fixed-rate mortgage: 5-6%

- Impact: Lower rates boost affordability, potentially leading to increased housing demand and market activity.

Navigating the Uncertainties: Strategies for Homebuyers and Owners

The uncertainty surrounding mortgage interest rates in 2025 presents both challenges and opportunities for individuals in the housing market.

For Homebuyers:

- Monitor Rate Trends: Stay informed about interest rate movements and adjust your buying strategy accordingly.

- Consider Locking in Rates: If rates are expected to rise, consider locking in a rate with a mortgage pre-approval.

- Explore Alternative Financing Options: Consider alternative financing options, such as adjustable-rate mortgages (ARMs) or government-backed loans, which may offer lower rates or more flexible terms.

For Homeowners:

- Refinance if Beneficial: If rates fall significantly, refinancing your existing mortgage could save you money on monthly payments.

- Consider a Home Equity Line of Credit (HELOC): A HELOC can provide access to low-interest credit if you need to tap into your home equity.

- Improve Energy Efficiency: Making your home more energy-efficient can lower your utility bills and potentially increase its value.

The Bottom Line

Predicting mortgage interest rate trends in 2025 is a complex endeavor. However, by understanding the key factors that influence rates and considering potential scenarios, individuals can make informed decisions about their housing plans. Whether rates rise, fall, or stabilize, staying informed and adaptable will be crucial for navigating the evolving housing market landscape.

Additional Considerations:

- Regional Variations: Mortgage rates can vary significantly across different regions, influenced by local economic conditions and housing market dynamics.

- Loan Type: Different loan types, such as fixed-rate mortgages, ARMs, and jumbo loans, carry varying interest rates.

- Credit Score: Your credit score plays a significant role in determining the interest rate you qualify for.

- Down Payment: A larger down payment can often lead to lower interest rates.

Conclusion

The mortgage interest rate landscape in 2025 will likely be shaped by a complex interplay of economic forces. While the future remains uncertain, by staying informed, understanding the key factors at play, and adapting their strategies, individuals can navigate this dynamic environment and make informed decisions about their housing goals. The housing market is a dynamic and unpredictable force, but with careful planning and a proactive approach, individuals can navigate the challenges and opportunities presented by the ever-evolving mortgage interest rate landscape.