Navigating The Uncharted Waters: Interest Rate Trends In 2025

Navigating the Uncharted Waters: Interest Rate Trends in 2025

The global financial landscape is a dynamic entity, constantly evolving with shifts in economic conditions, geopolitical events, and policy decisions. One of the most significant driving forces behind this evolution is interest rates, which play a crucial role in shaping investment decisions, consumer spending, and the overall health of economies.

Predicting the future of interest rates is a complex endeavor, fraught with uncertainty. However, by analyzing current trends, economic indicators, and potential catalysts, we can gain valuable insights into the potential trajectory of interest rates in 2025. This article delves into the key factors influencing interest rate trends, exploring the potential scenarios for 2025 and their implications for various stakeholders.

The Current Landscape: A Tale of Two Worlds

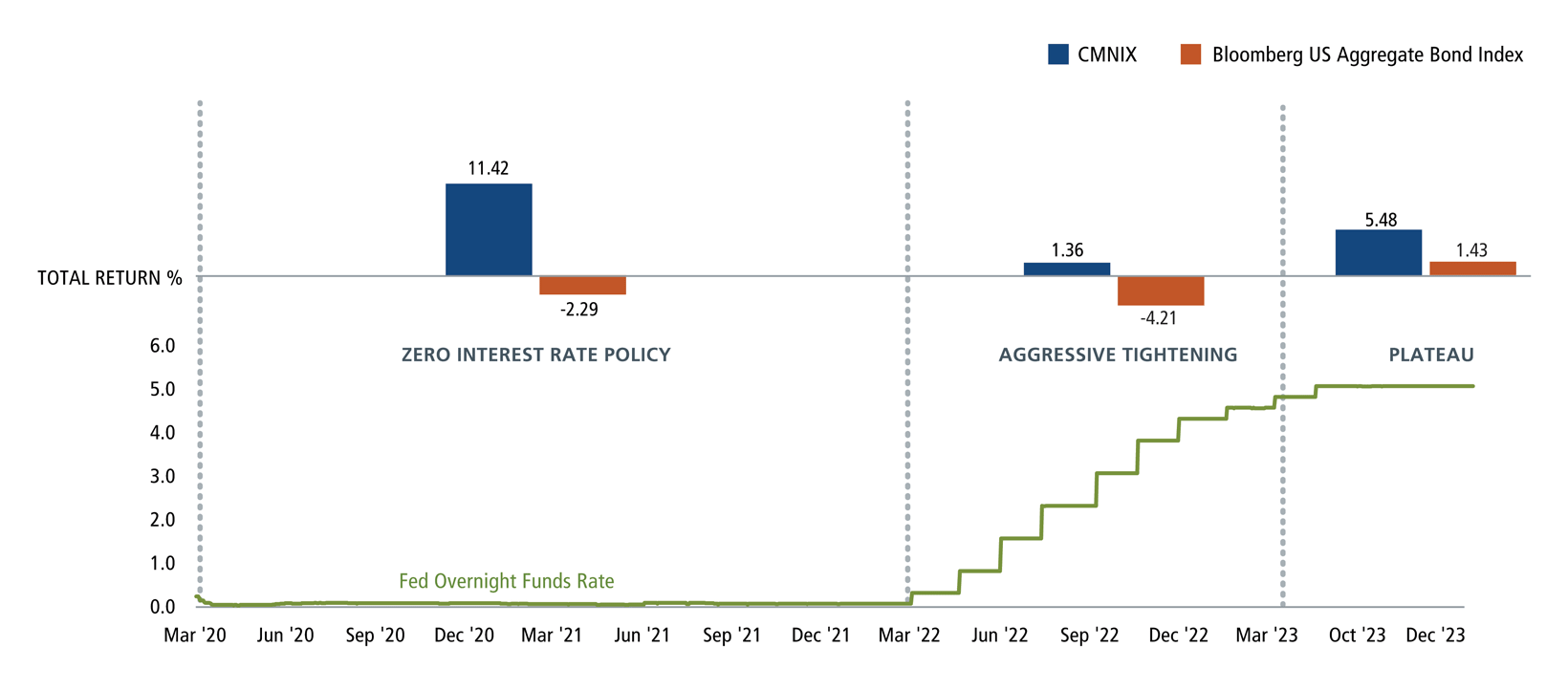

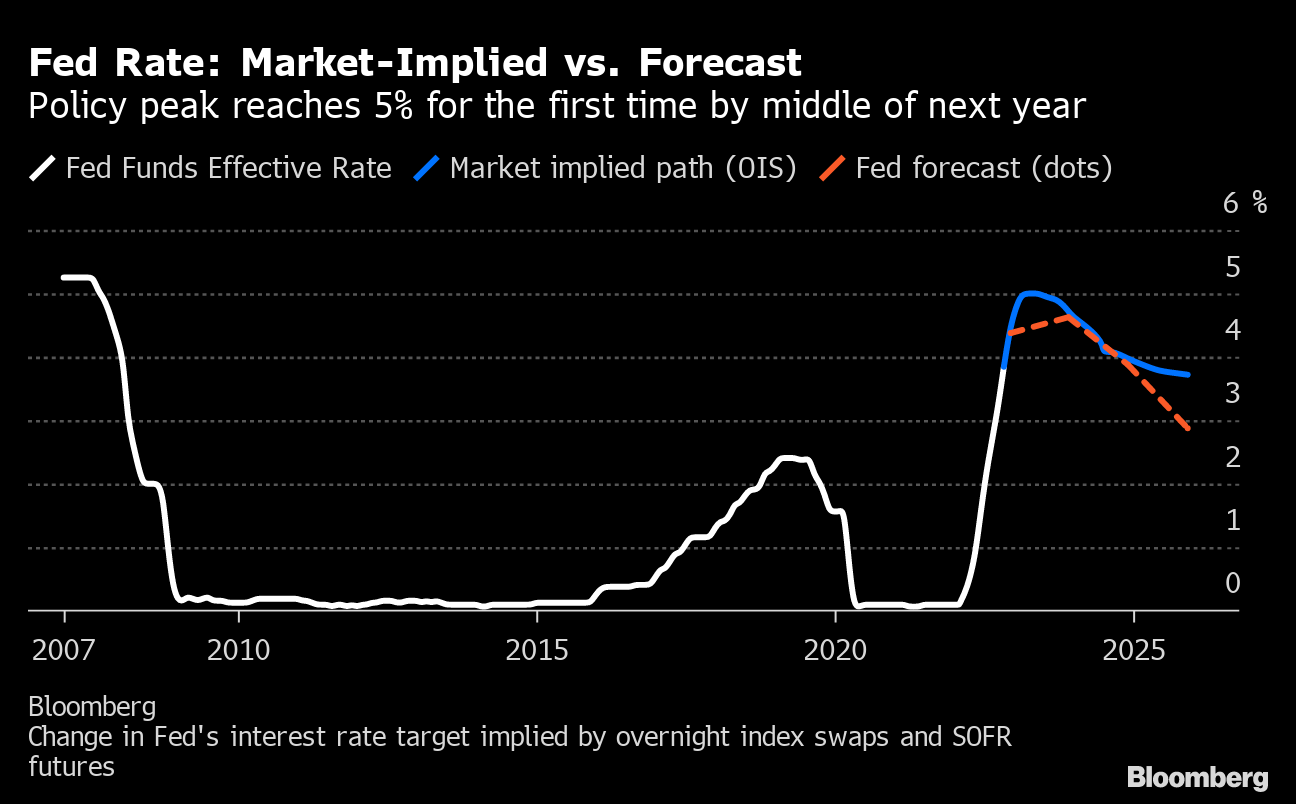

As we stand at the cusp of 2023, the global interest rate environment presents a stark dichotomy. In the United States, the Federal Reserve has aggressively raised interest rates in response to persistent inflation, pushing the benchmark rate to its highest level in over two decades. This hawkish stance aims to cool down the economy and curb inflationary pressures.

Meanwhile, other major economies like Japan and the Eurozone are grappling with deflationary pressures and sluggish economic growth. Their central banks are adopting a more accommodative approach, keeping interest rates low or even negative to stimulate economic activity.

This divergence in monetary policy reflects the diverse economic realities faced by different regions. The US economy is experiencing a robust labor market and strong consumer spending, contributing to persistent inflation. In contrast, the Eurozone and Japan are struggling with weak consumer confidence, geopolitical uncertainties, and lingering effects of the COVID-19 pandemic.

Factors Shaping Interest Rate Trends in 2025

Several key factors will shape the trajectory of interest rates in 2025, influencing decisions made by central banks and impacting financial markets and businesses alike.

1. Inflation: The Persistent Threat

Inflation remains a major concern for policymakers globally. While inflation rates have begun to moderate in some regions, they are still elevated in many others. The persistence of inflation will likely influence central bank decisions, with continued rate hikes a possibility if inflation proves sticky.

2. Economic Growth: A Balancing Act

Economic growth is another critical factor impacting interest rate trends. A robust economic expansion would likely lead to higher interest rates as central banks attempt to control inflation. Conversely, a slowdown in economic growth could prompt central banks to ease monetary policy, potentially leading to lower interest rates.

3. Geopolitical Uncertainties: A Shadow over the Horizon

Geopolitical tensions, particularly the ongoing war in Ukraine and the escalating rivalry between the US and China, contribute to economic uncertainty and volatility. These factors can influence investor sentiment and impact economic growth, potentially leading to unpredictable interest rate movements.

4. Monetary Policy: A Balancing Act

Central banks worldwide are navigating a complex path, trying to balance inflation control with economic growth. The decisions they make regarding interest rates will have a profound impact on financial markets, businesses, and individuals.

5. Technological Advancements: A Catalyst for Change

Technological advancements, particularly in areas like artificial intelligence, automation, and renewable energy, can significantly impact economic growth and inflation. These advancements could lead to increased productivity, potentially reducing inflationary pressures and influencing interest rate decisions.

Potential Scenarios for 2025

Based on the factors discussed above, several potential scenarios for interest rate trends in 2025 emerge:

Scenario 1: Continued Rate Hikes

If inflation remains stubbornly high and economic growth proves resilient, central banks could continue to raise interest rates in 2025. This scenario would likely lead to higher borrowing costs for businesses and individuals, potentially slowing down economic growth.

Scenario 2: Gradual Rate Reductions

As inflation begins to moderate and economic growth slows, central banks could gradually reduce interest rates in 2025. This scenario would create a more favorable environment for borrowing and investment, potentially stimulating economic activity.

Scenario 3: Interest Rate Stability

If inflation stabilizes at a manageable level and economic growth remains moderate, central banks could maintain interest rates at current levels in 2025. This scenario would provide a degree of stability for financial markets and businesses, allowing for more predictable planning and investment decisions.

Scenario 4: Diverging Interest Rate Paths

Given the diverse economic realities across regions, different central banks could pursue divergent interest rate policies in 2025. This scenario could lead to increased volatility in currency markets and potentially create opportunities for investors seeking to capitalize on regional differences.

Implications for Stakeholders

The potential interest rate trends in 2025 will have significant implications for various stakeholders:

1. Businesses:

- Higher borrowing costs: Businesses will face higher borrowing costs if interest rates continue to rise, potentially impacting their profitability and investment decisions.

- Increased uncertainty: The uncertain trajectory of interest rates can create challenges for businesses in planning and forecasting future financial performance.

- Potential for growth: Lower interest rates could stimulate business investment and economic growth, creating opportunities for expansion and job creation.

2. Consumers:

- Higher borrowing costs: Consumers will face higher interest rates on loans and mortgages, potentially limiting their spending power and impacting household budgets.

- Increased savings: Lower interest rates could encourage consumers to save more, potentially leading to a slowdown in consumer spending.

- Potential for lower mortgage rates: A decline in interest rates could translate to lower mortgage rates, making homeownership more affordable for some consumers.

3. Investors:

- Volatility in financial markets: Interest rate fluctuations can lead to increased volatility in financial markets, creating both opportunities and risks for investors.

- Shifting investment strategies: Investors may need to adjust their investment strategies based on the direction of interest rates, potentially favoring assets that perform well in different interest rate environments.

- Potential for higher returns: Higher interest rates can potentially lead to higher returns on fixed-income investments, attracting investors seeking stable income streams.

Conclusion: Navigating the Uncertainties

Predicting the future of interest rates is an inherently complex endeavor, influenced by a multitude of factors and subject to constant change. While the exact trajectory of interest rates in 2025 remains uncertain, understanding the key drivers and potential scenarios can help stakeholders navigate the challenges and opportunities that lie ahead.

By carefully monitoring economic indicators, geopolitical developments, and central bank actions, businesses, consumers, and investors can make informed decisions and adapt their strategies to the evolving interest rate landscape. The journey ahead may be uncertain, but by understanding the forces shaping the future of interest rates, we can better prepare for the opportunities and challenges that lie ahead.

![[Transformational] Navigating the Waters of US Interest Rates: Current](https://all-jisik.com/wp-content/uploads/2023/11/DALL%C2%B7E-2023-11-20-17.38.09-A-detailed-illustration-of-a-graph-showing-US-interest-rates-over-time.-The-graph-starts-from-2023-and-extends-into-2024-depicting-a-gradual-decline--768x768.png)