Navigating The Uncharted Waters: Interest Rate Trends In 2025

Navigating the Uncharted Waters: Interest Rate Trends in 2025

The year 2025 looms on the horizon, promising a landscape of economic uncertainties and shifting interest rate dynamics. While predicting the future with absolute certainty is impossible, understanding the forces shaping interest rates today allows us to navigate the potential trends of tomorrow. This article delves into the key factors influencing interest rate movements in 2025, exploring both the potential upswings and downswings, and offering insights into how individuals and businesses can prepare for the evolving financial landscape.

The Global Economic Landscape: A Complex Tapestry

The global economy in 2025 will be a complex tapestry woven from multiple threads, each influencing interest rate trajectories. The ongoing recovery from the COVID-19 pandemic, geopolitical tensions, supply chain disruptions, and the ever-present threat of inflation are just a few of the factors that will shape the economic environment.

1. Inflation: The Persistent Threat

Inflation, a persistent concern in recent years, will likely continue to be a major driver of interest rate decisions in 2025. Central banks worldwide are grappling with the need to control rising prices while maintaining economic growth. The trajectory of inflation will depend heavily on factors like:

- Supply Chain Resilience: The ability to restore disrupted supply chains and reduce bottlenecks will play a crucial role in easing inflationary pressures.

- Energy Prices: The volatility of energy prices, particularly oil, will continue to influence overall inflation levels.

- Wage Growth: Rising wages can fuel inflation if they outpace productivity gains. However, they also signal a healthy economy, potentially leading to increased consumer spending.

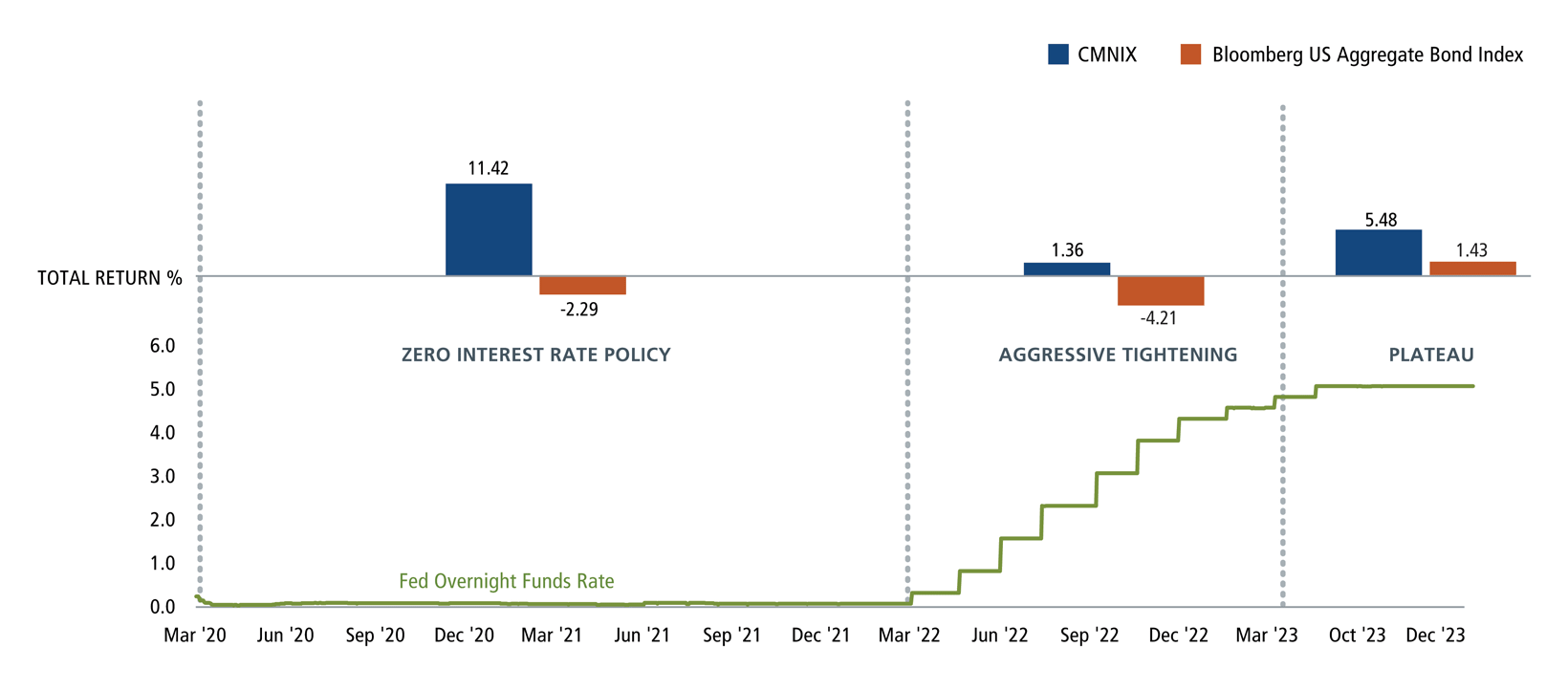

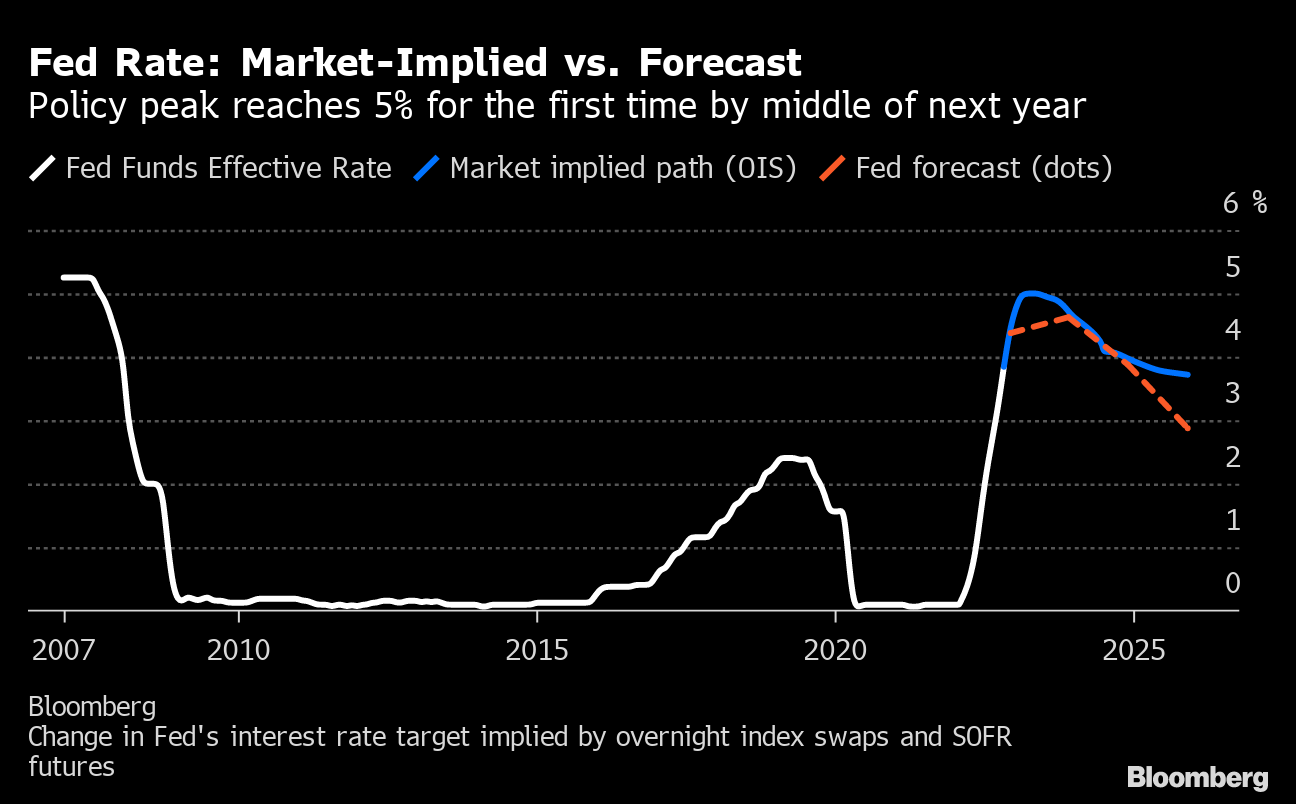

2. Monetary Policy: A Balancing Act

Central banks worldwide are walking a tightrope, trying to balance inflation control with economic growth. The path of monetary policy in 2025 will be crucial in shaping interest rate trends.

- Interest Rate Hikes: If inflation remains elevated, central banks are likely to continue raising interest rates to cool down the economy. However, the pace and magnitude of these hikes will depend on the specific economic conditions in each region.

- Quantitative Tightening (QT): Central banks may also continue to reduce their asset holdings, further tightening monetary conditions and pushing interest rates upwards.

- Policy Pivot: However, if inflation starts to moderate significantly, central banks could pivot towards a more accommodative stance, potentially pausing or even reversing rate hikes.

3. Geopolitical Uncertainty: A Wild Card

Geopolitical tensions, particularly the ongoing conflict in Ukraine, are adding significant uncertainty to the global economic outlook. These tensions can disrupt trade flows, impact energy prices, and lead to increased volatility in financial markets.

- Energy Supply Disruptions: The war in Ukraine has already led to energy supply disruptions and price spikes, impacting global inflation and economic growth.

- Financial Market Volatility: Geopolitical uncertainties can trigger increased volatility in financial markets, potentially leading to higher risk premiums and increased borrowing costs.

- Sanctions and Trade Wars: Ongoing sanctions and potential trade wars can further disrupt global supply chains and negatively impact economic growth.

4. Technological Advancements: A Catalyst for Change

Technological advancements, particularly in areas like artificial intelligence and automation, are poised to have a profound impact on the economy and potentially influence interest rate trends.

- Productivity Gains: Technological advancements can lead to increased productivity, potentially offsetting inflationary pressures and allowing for lower interest rates.

- Job Market Disruption: Automation and AI could lead to job displacement in certain sectors, potentially impacting wage growth and consumer spending.

- Financial Innovation: Fintech innovations are transforming the financial landscape, potentially leading to new ways of lending and borrowing, which could impact interest rate dynamics.

Interest Rate Scenarios in 2025: A Glimpse into the Future

While predicting the future with certainty is impossible, we can explore potential scenarios based on the current economic and geopolitical landscape.

Scenario 1: Persistent Inflation and Tightening Monetary Policy

- Key Drivers: High inflation, ongoing supply chain disruptions, and geopolitical tensions.

- Interest Rate Outlook: Continued interest rate hikes by central banks, potentially leading to higher borrowing costs for businesses and consumers.

- Impact: Slower economic growth, potential recessionary pressures, and a challenging environment for businesses and investors.

Scenario 2: Moderating Inflation and Gradual Policy Normalization

- Key Drivers: Easing supply chain pressures, falling energy prices, and controlled wage growth.

- Interest Rate Outlook: Gradual interest rate increases, followed by a stabilization period as central banks monitor inflation and economic growth.

- Impact: More stable economic growth, moderate borrowing costs, and a more favorable environment for businesses and investors.

Scenario 3: Deflationary Pressures and Policy Shift

- Key Drivers: Significant economic slowdown, global recession, and a sharp decline in consumer demand.

- Interest Rate Outlook: Potential interest rate cuts by central banks to stimulate economic growth and prevent deflation.

- Impact: Lower borrowing costs, potential increase in investment and consumer spending, but also risks of asset bubbles and financial instability.

Navigating the Uncharted Waters: Strategies for Individuals and Businesses

Regardless of the specific interest rate path in 2025, individuals and businesses need to be prepared for the evolving financial landscape. Here are some strategies to navigate the uncharted waters:

For Individuals:

- Manage Debt: Pay down high-interest debt to minimize the impact of rising interest rates.

- Save and Invest: Maintain a healthy emergency fund and consider investing in assets that are less sensitive to interest rate fluctuations.

- Diversify Investments: Spread your investments across different asset classes to reduce overall risk.

- Monitor Interest Rates: Stay informed about interest rate movements and their potential impact on your finances.

For Businesses:

- Manage Cash Flow: Ensure sufficient cash flow to weather potential economic downturns and rising borrowing costs.

- Review Debt Structure: Consider refinancing existing debt to lower interest payments or locking in fixed rates.

- Invest in Innovation: Focus on investments that enhance productivity and efficiency, potentially mitigating the impact of rising costs.

- Develop Contingency Plans: Plan for different economic scenarios and be prepared to adjust strategies as needed.

Conclusion: A Time for Vigilance and Adaptability

The year 2025 promises a landscape of economic uncertainties and shifting interest rate dynamics. While predicting the future with absolute certainty is impossible, understanding the forces shaping interest rates today allows us to navigate the potential trends of tomorrow. By staying informed, managing risk effectively, and adapting to the evolving economic environment, individuals and businesses can position themselves for success in the uncharted waters of the future.

![[Transformational] Navigating the Waters of US Interest Rates: Current](https://all-jisik.com/wp-content/uploads/2023/11/DALL%C2%B7E-2023-11-20-17.38.09-A-detailed-illustration-of-a-graph-showing-US-interest-rates-over-time.-The-graph-starts-from-2023-and-extends-into-2024-depicting-a-gradual-decline--768x768.png)