Navigating The Uncharted Waters: Interest Rate Trends In 2025

Navigating the Uncharted Waters: Interest Rate Trends in 2025

The year 2025 seems a distant future, but in the realm of finance, it’s a crucial horizon. Interest rates, those invisible forces that govern borrowing, lending, and economic growth, are always in flux. Predicting their trajectory is a complex task, laden with uncertainties. However, by analyzing current trends, economic indicators, and potential geopolitical events, we can attempt to sketch a potential landscape for interest rates in 2025.

The Global Economic Context:

Several factors will shape the interest rate environment in 2025, and understanding the global economic context is paramount.

-

Inflation’s Persistent Shadow: Inflation, a persistent concern for many economies, is expected to remain a major factor influencing interest rates. While central banks have aggressively raised rates to combat inflation, the path to sustained price stability is uncertain. If inflation proves stickier than anticipated, central banks may continue to raise rates, keeping borrowing costs elevated.

-

Growth Uncertainties: The global economy is navigating a complex web of challenges, from geopolitical tensions to supply chain disruptions. The pace of economic growth in 2025 will depend on how these challenges are addressed. Slower growth could lead to lower interest rates as central banks try to stimulate economic activity. Conversely, robust growth might necessitate higher rates to manage inflation.

-

Geopolitical Volatility: Geopolitical tensions, particularly the ongoing conflict in Ukraine and the evolving relationship between the US and China, introduce significant uncertainty. These tensions can impact energy markets, supply chains, and global trade, ultimately influencing economic growth and interest rate decisions.

Central Bank Strategies:

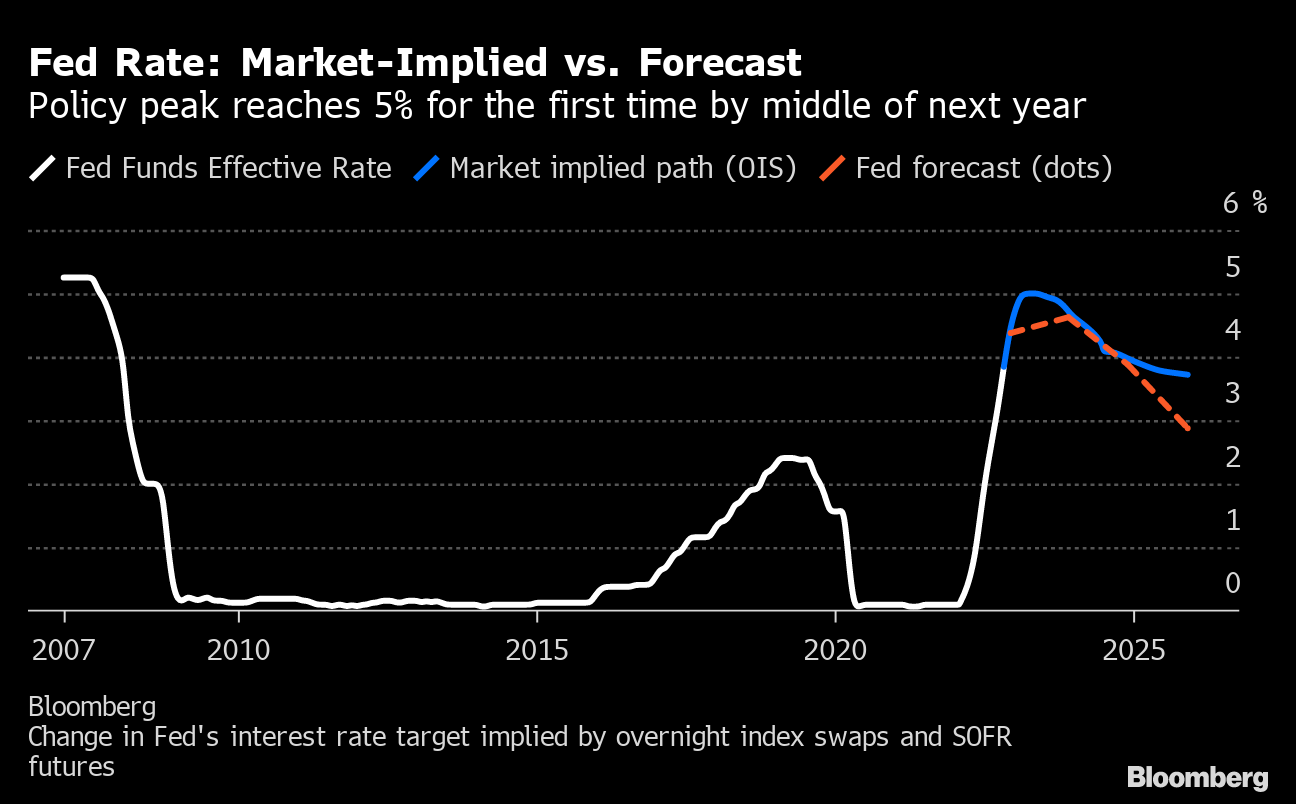

Central banks play a crucial role in shaping interest rate trends. Their actions, guided by inflation targets and economic growth projections, will heavily influence the direction of rates.

-

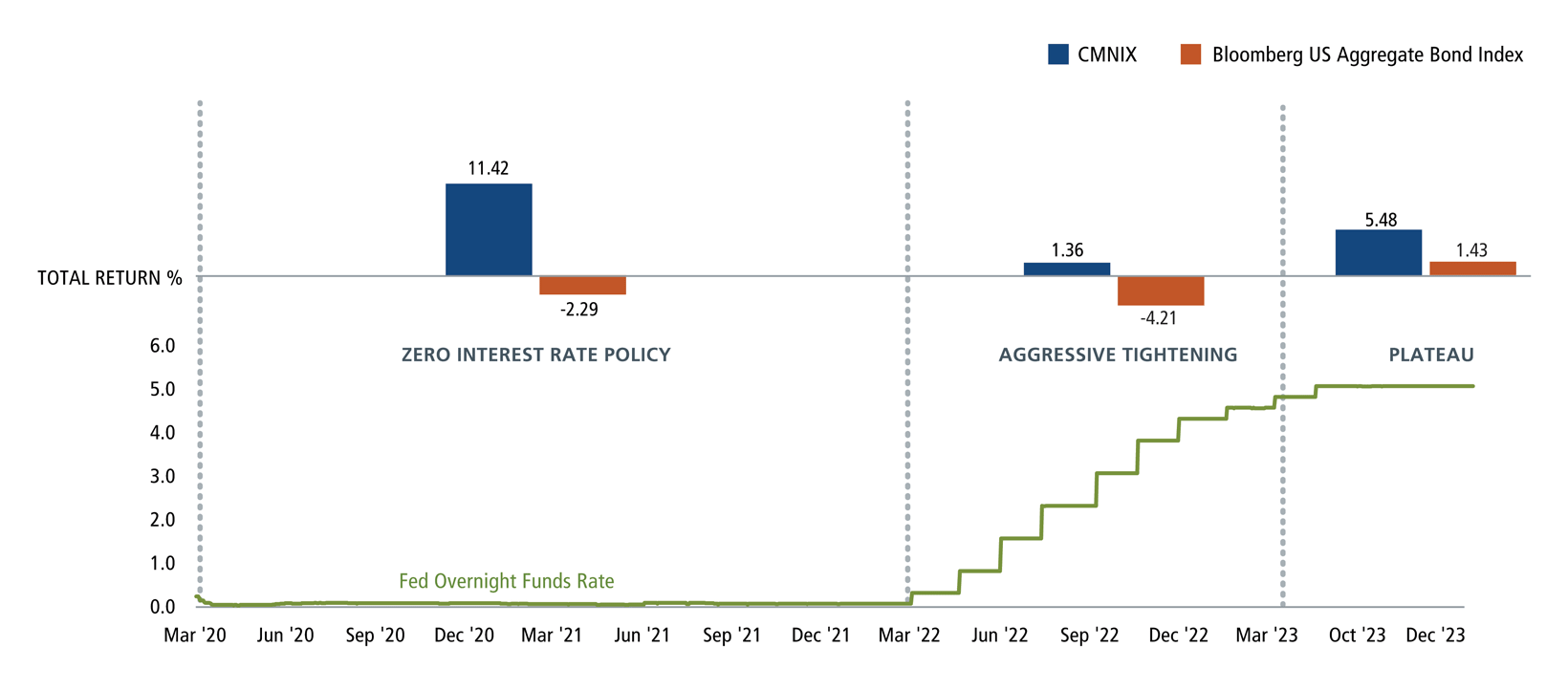

The Pivot to Stability: Central banks are likely to focus on achieving price stability in the coming years. While the pace of rate hikes may slow down, central banks are likely to maintain higher interest rates for a prolonged period to ensure inflation remains under control.

-

Data Dependency: Central bank decisions will be data-driven. They will closely monitor inflation, employment, and other economic indicators to assess the impact of their policies. This data-dependent approach could lead to adjustments in interest rates as economic conditions evolve.

-

Communication and Transparency: Central banks will need to communicate their strategies clearly to ensure market stability. Transparency about their objectives and policy decisions will be crucial to avoid market volatility and maintain confidence in the financial system.

Sectoral Impacts:

Interest rate trends have a significant impact on various sectors of the economy.

-

Housing Market: Rising interest rates have already cooled the housing market, making mortgages more expensive. In 2025, the impact of interest rates on housing will continue, potentially leading to a more balanced market with slower price growth.

-

Corporate Investment: Higher interest rates can make borrowing more expensive for businesses, potentially hindering investment and expansion plans. Companies may need to adjust their strategies to navigate the higher cost of capital.

-

Consumer Spending: Increased borrowing costs can impact consumer spending, as individuals may need to cut back on discretionary expenses due to higher interest payments on loans and credit cards.

The Outlook for 2025:

Predicting interest rates with certainty is impossible. However, considering the current trends and potential scenarios, several possibilities emerge:

-

Scenario 1: Continued Tightening: If inflation proves persistent and economic growth remains strong, central banks may continue raising interest rates in 2025. This scenario could lead to higher borrowing costs for businesses and consumers, potentially slowing economic activity.

-

Scenario 2: Gradual Stabilization: Central banks may shift their focus from aggressive rate hikes to a more gradual approach, aiming to stabilize interest rates at a higher level. This scenario could provide some relief for borrowers while still keeping inflation under control.

-

Scenario 3: Early Rate Cuts: If economic growth weakens significantly or inflation shows signs of a rapid decline, central banks might consider easing monetary policy by lowering interest rates. This scenario could boost economic activity but might also risk reigniting inflationary pressures.

Navigating the Uncertainty:

The future of interest rates in 2025 is shrouded in uncertainty. It’s crucial for individuals, businesses, and investors to remain informed and adapt their strategies to the evolving economic landscape.

-

Financial Planning: Individuals should review their financial plans and consider the potential impact of higher interest rates on their savings, investments, and borrowing costs.

-

Investment Strategies: Investors should carefully assess the risk-reward profile of their investments, considering the potential impact of interest rate changes on asset valuations.

-

Business Decisions: Businesses need to be prepared for potential changes in borrowing costs and adjust their investment and pricing strategies accordingly.

Conclusion:

The path of interest rates in 2025 will be shaped by a complex interplay of economic, geopolitical, and central bank factors. While predicting the future with certainty is impossible, understanding the current trends and potential scenarios can help individuals, businesses, and investors navigate the uncertain waters ahead. By remaining informed, adaptable, and proactive, we can position ourselves to thrive in the evolving interest rate environment.

![[Transformational] Navigating the Waters of US Interest Rates: Current](https://all-jisik.com/wp-content/uploads/2023/11/DALL%C2%B7E-2023-11-20-17.38.09-A-detailed-illustration-of-a-graph-showing-US-interest-rates-over-time.-The-graph-starts-from-2023-and-extends-into-2024-depicting-a-gradual-decline--768x768.png)