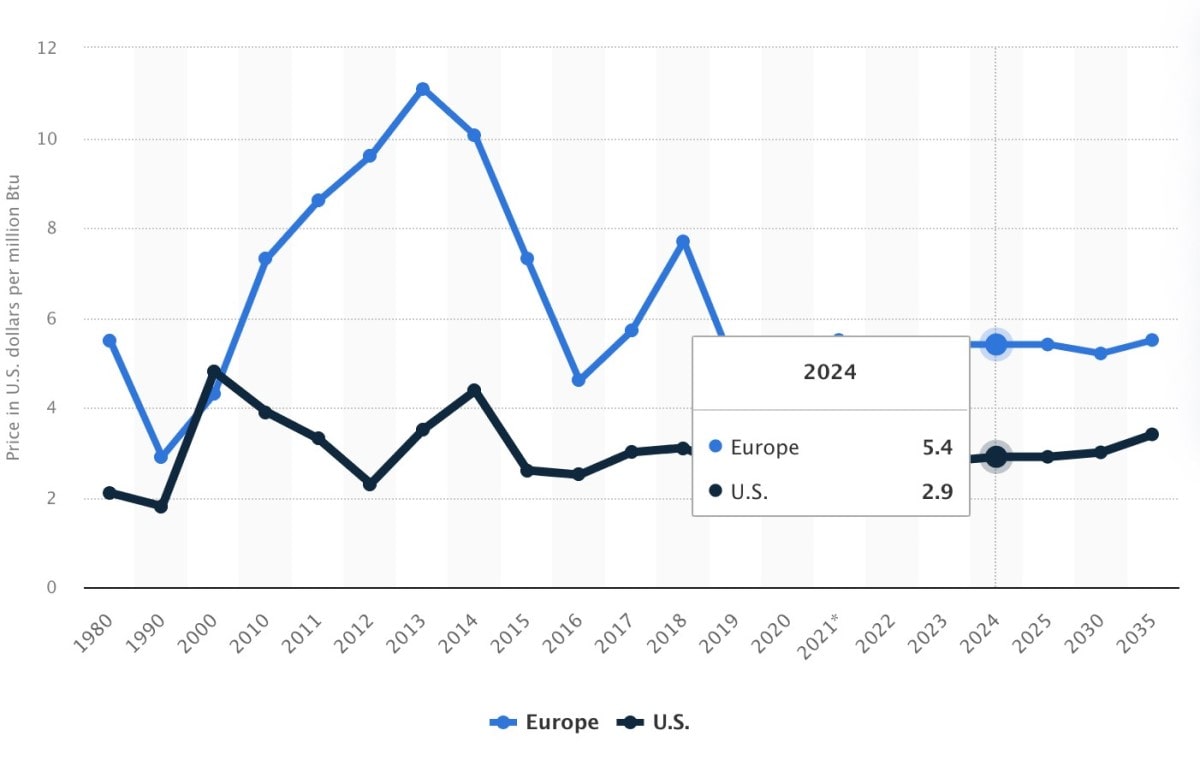

Navigating The Uncharted Waters: Gas Price Trends In 2025

Navigating the Uncharted Waters: Gas Price Trends in 2025

The year 2025 feels like a distant future, yet the question of gas prices continues to loom large, impacting our wallets and influencing our daily decisions. While predicting the future is an inherently risky endeavor, understanding the factors that drive gas prices allows us to navigate the uncertainty and anticipate potential trends. This article delves into the complex landscape of gas price trends in 2025, examining key drivers, potential scenarios, and the implications for consumers and the global economy.

The Shifting Sands: Global Factors Shaping Gas Prices

The global energy landscape is a dynamic system, constantly evolving under the influence of geopolitical shifts, technological advancements, and environmental concerns. These factors exert a significant influence on gas prices, making it crucial to consider them when projecting future trends.

1. Geopolitical Instability and Conflict:

Geopolitical tensions, particularly in regions like the Middle East, remain a major driver of oil price volatility. Conflicts, sanctions, and political instability can disrupt supply chains, leading to price spikes. The ongoing war in Ukraine, for example, has significantly impacted global energy markets, pushing prices higher. While predicting future conflicts is impossible, understanding the potential for instability in key oil-producing regions is crucial.

2. The Rise of Renewable Energy:

The transition to renewable energy sources like solar and wind power is gaining momentum, posing a potential challenge to the dominance of fossil fuels. As renewable energy technologies become more efficient and affordable, they may gradually displace oil as a primary energy source. This shift could lead to a decline in oil demand, potentially impacting gas prices in the long term. However, the transition to renewable energy is a gradual process, and the immediate impact on gas prices is likely to be limited.

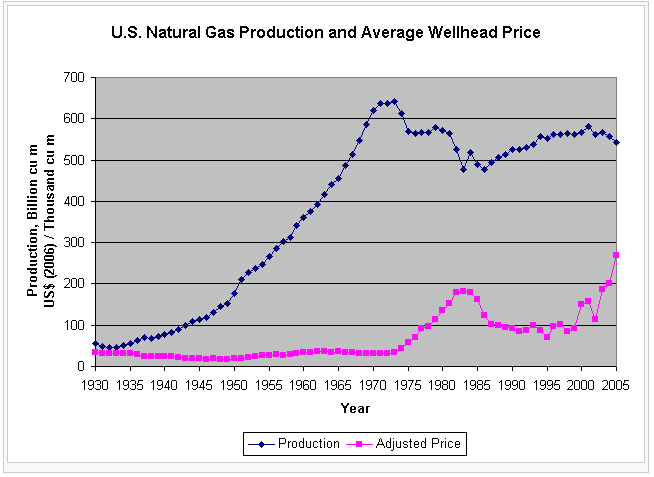

3. The Role of OPEC and Global Oil Production:

The Organization of the Petroleum Exporting Countries (OPEC) plays a significant role in regulating global oil supply. OPEC’s production decisions, often influenced by geopolitical considerations, directly impact oil prices. While OPEC’s influence has diminished in recent years, its actions still hold significant sway over the global energy market. The potential for increased production from countries like Saudi Arabia and Russia could influence price trends, potentially leading to lower gas prices. Conversely, any disruptions in production or unexpected geopolitical events could lead to price spikes.

4. The Growing Demand from Emerging Economies:

The economic growth of emerging economies, particularly in Asia, is driving a surge in global energy demand. As these economies develop, their transportation sectors expand, leading to an increased reliance on oil. This growing demand could put upward pressure on gas prices, especially if supply remains constrained.

5. Technological Advancements and Efficiency Gains:

Technological advancements are impacting the oil and gas industry in multiple ways. The development of new drilling technologies, enhanced recovery techniques, and the use of artificial intelligence are increasing oil production efficiency and potentially lowering costs. These advancements could contribute to lower gas prices. However, these technological developments are often counterbalanced by rising costs associated with exploration and extraction in more challenging environments.

6. The Impact of Climate Change Policies:

The global push to combat climate change is driving a shift towards cleaner energy sources and influencing energy policies. Governments worldwide are implementing carbon taxes, emissions regulations, and other measures to reduce fossil fuel consumption. These policies could potentially impact gas prices by increasing the cost of production and distribution. However, the effectiveness of these policies in curbing oil demand and influencing gas prices remains uncertain.

Scenario Planning: Navigating the Uncertainties

Given the complex interplay of these factors, predicting gas prices with certainty is impossible. However, by considering different scenarios, we can gain valuable insights into potential price trends and their implications.

Scenario 1: Continued Geopolitical Volatility and High Demand

This scenario assumes continued geopolitical instability, particularly in key oil-producing regions, coupled with strong global economic growth and rising demand from emerging markets. This combination could lead to persistent supply disruptions, putting upward pressure on oil prices and consequently, gas prices. Consumers could face higher fuel costs, impacting their budgets and potentially influencing transportation choices.

Scenario 2: A Transition to Renewable Energy and Declining Demand

This scenario envisions a rapid transition to renewable energy sources, driven by technological advancements, falling costs, and supportive government policies. As renewable energy becomes more competitive, demand for oil could decline, leading to lower oil prices and potentially lower gas prices. This scenario could benefit consumers, but it also poses challenges for the oil and gas industry, requiring a significant shift in investment and infrastructure.

Scenario 3: A Moderate Shift in Energy Consumption and Prices

This scenario anticipates a gradual shift towards cleaner energy sources, with a balanced mix of renewable and fossil fuels. Global economic growth is expected to continue, but at a more moderate pace. This scenario suggests a gradual increase in gas prices, driven by factors like rising demand from emerging economies and geopolitical uncertainties. However, price increases are likely to be moderate, allowing for a more stable energy market.

Implications for Consumers and the Global Economy

The future of gas prices has significant implications for consumers and the global economy.

For Consumers:

- Higher fuel costs: Rising gas prices directly impact consumers’ budgets, leaving less disposable income for other expenses. This can lead to reduced spending and potentially impact economic growth.

- Transportation choices: High gas prices could incentivize consumers to consider more fuel-efficient vehicles or alternative transportation options like public transit or cycling.

- Inflationary pressures: Rising gas prices contribute to overall inflation, impacting the cost of goods and services across the economy.

For the Global Economy:

- Economic growth: High gas prices can dampen economic growth by increasing transportation costs for businesses and consumers.

- Energy security: The reliance on fossil fuels raises concerns about energy security, particularly in countries with limited domestic oil production.

- Environmental impact: The continued use of fossil fuels contributes to climate change, highlighting the need for a transition to cleaner energy sources.

Navigating the Future: Adapting to Changing Trends

The future of gas prices remains uncertain, but understanding the factors driving these trends allows us to prepare for potential outcomes. Consumers can consider measures like:

- Fuel efficiency: Choosing fuel-efficient vehicles or adopting alternative transportation options can help mitigate the impact of rising gas prices.

- Budgeting: Planning for potential price fluctuations and incorporating fuel costs into budgets can help manage financial strain.

- Energy conservation: Reducing energy consumption through measures like driving less, using public transportation, and adopting energy-saving practices can help minimize the impact of rising gas prices.

For policymakers, the challenge lies in balancing economic growth with environmental sustainability. This requires:

- Investing in renewable energy: Promoting research and development, providing incentives for renewable energy projects, and creating a favorable regulatory environment can accelerate the transition to cleaner energy sources.

- Developing energy efficiency standards: Implementing stricter fuel efficiency standards for vehicles and promoting energy-saving technologies can reduce demand for fossil fuels.

- Addressing geopolitical risks: Engaging in diplomacy and promoting stability in oil-producing regions can help mitigate supply disruptions and price volatility.

The journey towards a sustainable energy future will be complex and challenging, but by understanding the factors driving gas price trends and adopting proactive measures, we can navigate the uncertainties and build a more resilient and sustainable energy system.