Navigating The Uncharted Waters: A Deep Dive Into Mortgage Rate Trends For 2025

Navigating the Uncharted Waters: A Deep Dive into Mortgage Rate Trends for 2025

The housing market, a cornerstone of economic stability, is constantly in flux, driven by a complex interplay of factors, including interest rates. Predicting mortgage rate trends, particularly over the long term, is a challenging endeavor. However, by analyzing historical data, current economic conditions, and expert projections, we can gain valuable insights into potential trajectories for mortgage rates in 2025.

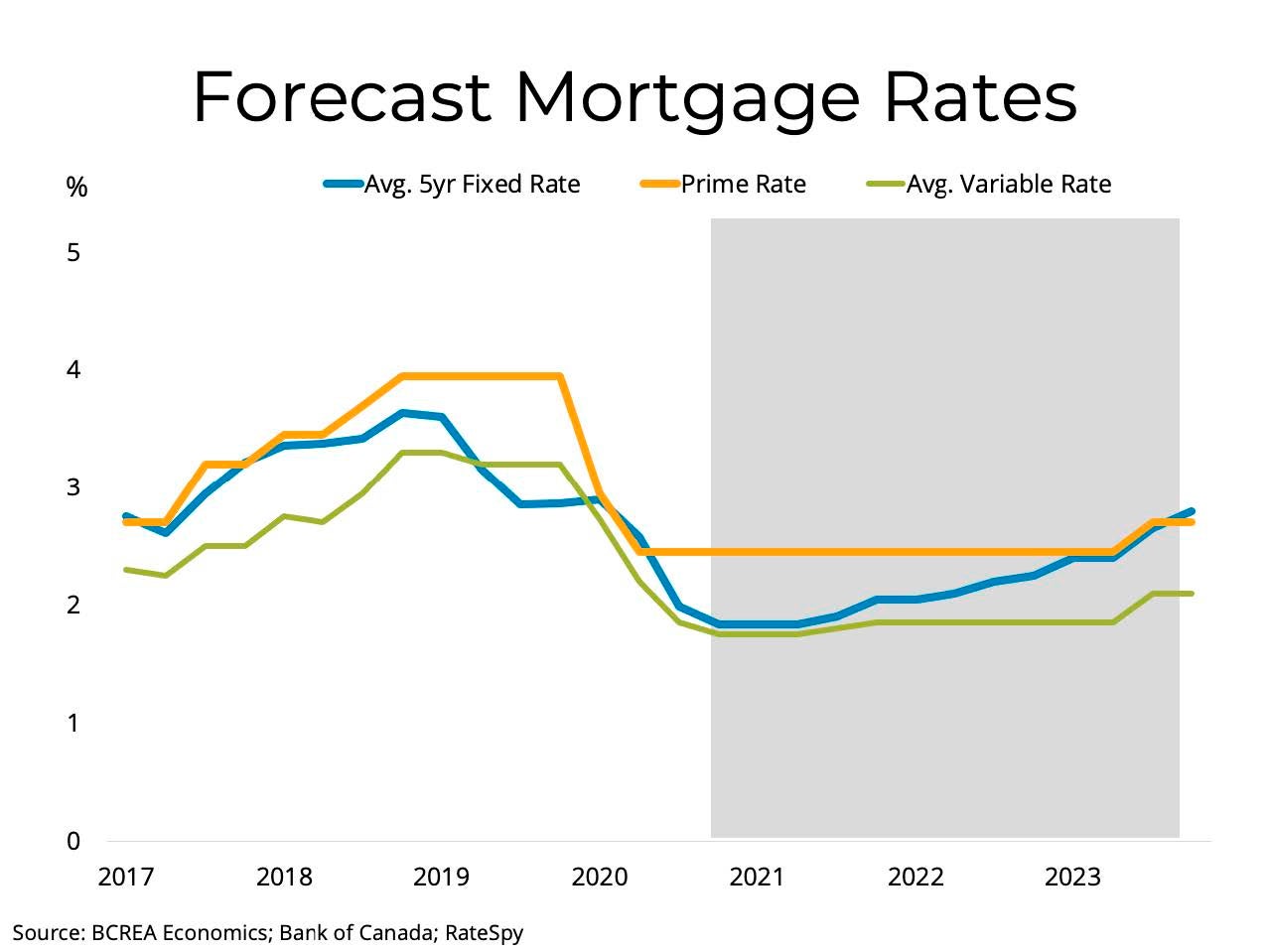

A Historical Perspective: The Rollercoaster Ride of Mortgage Rates

To understand where mortgage rates might head in 2025, it’s crucial to examine their historical performance. The past century has witnessed significant fluctuations, shaped by events such as wars, recessions, and policy changes.

The 20th Century:

- Post-World War II: The years following World War II saw a surge in homeownership, fueled by low mortgage rates and government support. Rates hovered around 4% in the 1950s and 1960s, making homeownership more accessible.

- The 1970s: The decade witnessed a dramatic shift, with inflation soaring and the Federal Reserve aggressively raising interest rates to combat it. Mortgage rates peaked at over 18% in 1981, significantly dampening housing demand.

- The 1980s and 1990s: The 1980s saw a gradual decline in mortgage rates, driven by economic stabilization and a more accommodative monetary policy. The 1990s continued this trend, with rates reaching record lows below 7% by the end of the decade.

The 21st Century:

- The 2000s: The early 2000s were characterized by historically low mortgage rates, a period of economic expansion, and a booming housing market. However, the housing bubble burst in 2007, leading to the global financial crisis.

- The 2010s: The aftermath of the financial crisis saw the Federal Reserve implementing quantitative easing and keeping interest rates near zero. Mortgage rates remained relatively low, supporting a slow but steady recovery in the housing market.

- The 2020s: The COVID-19 pandemic led to a surge in demand for housing, fueled by low interest rates and remote work trends. This resulted in a rapid increase in home prices and a tight inventory market.

The Current Landscape: A Tale of Two Forces

As we approach 2025, the mortgage rate landscape is characterized by two opposing forces:

1. Inflation and Rising Interest Rates:

- The Federal Reserve has been aggressively raising interest rates to combat persistent inflation. This upward pressure on the cost of borrowing is likely to continue in the near term, influencing mortgage rates.

- Inflationary pressures, driven by supply chain disruptions, high energy prices, and strong consumer demand, are expected to remain a concern in the coming years. This could further necessitate rate hikes, putting upward pressure on mortgage rates.

- The Fed’s actions are aimed at curbing economic growth and bringing inflation back to its 2% target. However, the effectiveness of these measures and their impact on the housing market remain uncertain.

2. Economic Uncertainty and Market Volatility:

- The global economic outlook remains uncertain, with geopolitical tensions, supply chain disruptions, and the ongoing war in Ukraine posing significant risks.

- The possibility of a recession in the US and other major economies could lead to a decline in housing demand and potentially lower mortgage rates.

- The Federal Reserve’s aggressive rate hikes could also trigger a recession by slowing down economic growth. However, the timing and severity of a potential recession remain unclear.

Expert Projections: Navigating the Fog of Uncertainty

Predicting mortgage rates in 2025 is a complex task, but experts offer a range of perspectives:

1. The Optimistic View:

- Some analysts believe that inflation will moderate in the coming years, allowing the Federal Reserve to pause its rate hikes and even begin cutting rates by 2025.

- This scenario could lead to a decline in mortgage rates, potentially returning them to levels closer to those seen in the early 2020s.

- However, this view hinges on a rapid and sustained decline in inflation, which remains uncertain given the current global economic climate.

2. The Pessimistic View:

- Other experts predict that inflation will remain stubbornly high, forcing the Federal Reserve to continue raising interest rates beyond 2023.

- This scenario could lead to mortgage rates exceeding 7% or even 8% by 2025, significantly impacting housing affordability and market activity.

- The possibility of a recession further amplifies this pessimistic outlook, as it could lead to a decline in home values and a slowdown in demand.

3. The Neutral View:

- Some analysts believe that mortgage rates will remain relatively stable in the coming years, fluctuating around current levels.

- This view suggests that inflation will gradually moderate, but not rapidly enough to prompt significant rate cuts.

- The Federal Reserve will likely continue to monitor economic conditions and adjust its monetary policy accordingly, leading to a more balanced approach.

The Importance of a Balanced Approach

Predicting mortgage rates in 2025 requires a nuanced approach, considering both the positive and negative factors at play. It’s crucial to avoid relying solely on optimistic or pessimistic projections and instead focus on understanding the range of potential outcomes.

Factors to Consider:

- Economic Growth: The pace of economic growth will be a key determinant of mortgage rates. Strong economic growth could lead to higher inflation and necessitate further rate hikes, while a slowdown in growth could prompt rate cuts.

- Inflation: The trajectory of inflation will have a significant impact on mortgage rates. If inflation remains high, the Federal Reserve will likely continue raising rates, while a decline in inflation could lead to a pause or even cuts.

- Housing Demand: The level of demand for housing will also influence mortgage rates. Strong demand could lead to higher prices and put upward pressure on rates, while weak demand could lead to lower prices and potentially lower rates.

- Government Policy: Government policies, such as tax incentives for homeownership, can impact housing demand and mortgage rates. Changes in these policies could influence the affordability of housing and the attractiveness of homeownership.

Navigating the Uncharted Waters: Strategies for Homebuyers and Sellers

Given the uncertainty surrounding mortgage rates in 2025, it’s crucial for homebuyers and sellers to adopt a strategic approach:

Homebuyers:

- Be Prepared for Volatility: Be aware that mortgage rates could fluctuate significantly in the coming years. Avoid locking into a fixed-rate mortgage unless you are confident in your ability to handle potential rate increases.

- Consider Adjustable-Rate Mortgages (ARMs): ARMs offer lower initial rates but can adjust over time. This option could be beneficial if you plan to sell your home before the interest rate adjusts significantly.

- Improve Your Credit Score: A higher credit score can qualify you for lower interest rates. Take steps to improve your creditworthiness by paying bills on time and reducing debt.

- Save for a Larger Down Payment: A larger down payment can reduce your loan amount and potentially lower your monthly payments.

- Be Patient and Flexible: Don’t rush into buying a home just because rates are currently low. Be patient and wait for the right opportunity, even if it means delaying your purchase.

Home Sellers:

- Stay Informed about Market Trends: Monitor mortgage rate trends and their potential impact on housing demand.

- Price Your Home Competitively: In a market with higher mortgage rates, buyers may be more sensitive to price. Ensure your home is priced attractively to attract potential buyers.

- Consider Offering Incentives: Offering incentives, such as a lower interest rate buy-down or closing cost assistance, can make your home more appealing to buyers.

- Be Prepared for a Longer Selling Cycle: Higher mortgage rates can lead to a slower market, meaning it may take longer to find a buyer.

Conclusion: Embracing Flexibility and Adaptability

Predicting mortgage rates in 2025 is an exercise in uncertainty, with a wide range of potential outcomes. However, by understanding the historical trends, current economic conditions, and expert projections, we can gain valuable insights into the potential trajectory of mortgage rates.

The key to navigating this uncertain landscape is to embrace flexibility and adaptability. Homebuyers should be prepared for potential rate fluctuations and consider options such as ARMs or larger down payments. Home sellers should stay informed about market trends and price their homes competitively.

Ultimately, the future of mortgage rates is intertwined with the broader economic outlook. As we navigate this uncertain period, it’s crucial to remain informed, adapt to changing conditions, and make informed decisions that align with our individual financial goals.

![Navigating Uncharted Waters [Investing Insights] - YouTube](https://i.ytimg.com/vi/9EnLowB1CB8/maxresdefault.jpg)