Navigating The Stock Market In 2025: Trends And Opportunities

Navigating the Stock Market in 2025: Trends and Opportunities

The year is 2025. The world has been reshaped by technological advancements, global geopolitical shifts, and the ever-present need to address climate change. As we navigate this new landscape, the stock market, a reflection of economic activity and investor sentiment, presents both challenges and opportunities. Understanding the key trends shaping the market is crucial for investors seeking to capitalize on emerging sectors and navigate potential pitfalls.

The Rise of the Tech Titans:

Technology continues to dominate the stock market landscape. The "FAANG" giants (Facebook, Apple, Amazon, Netflix, and Google) have expanded their reach, becoming behemoths with global influence. This dominance is likely to continue, fueled by advancements in artificial intelligence (AI), cloud computing, and the burgeoning metaverse.

- AI-Driven Growth: AI is revolutionizing industries, from healthcare to finance. Companies specializing in AI development, data analytics, and machine learning are poised for significant growth. Investors should look for companies with strong AI expertise, innovative solutions, and ethical AI practices.

- Cloud Computing Expansion: The cloud continues to be a major driver of growth. Companies like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform are expanding their offerings, providing infrastructure and services to businesses of all sizes. Investing in cloud computing infrastructure providers and companies leveraging cloud services effectively can be a strategic move.

- The Metaverse Emerges: The metaverse, a virtual reality-based interconnected network of digital spaces, is gaining traction. Companies developing VR/AR hardware, gaming platforms, and virtual experiences are likely to see increased investor interest. However, the metaverse is still in its early stages, and investors should proceed with caution, focusing on companies with strong financial fundamentals and clear business models.

Sustainable Investing Takes Center Stage:

Environmental, social, and governance (ESG) factors are no longer niche considerations. They are becoming integral to investment decisions, as investors prioritize companies aligned with sustainability goals.

- Clean Energy Boom: The transition to a low-carbon economy is accelerating. Companies involved in renewable energy production, energy storage solutions, and electric vehicle manufacturing are attracting significant investment.

- Circular Economy Solutions: Companies promoting sustainable practices, reducing waste, and implementing circular economy models are gaining favor. Investors are seeking companies with robust recycling programs, eco-friendly packaging, and responsible sourcing practices.

- Social Impact Investing: Investing in companies addressing social issues like poverty, healthcare access, and education is gaining momentum. Investors are looking for companies with a positive social impact, transparent reporting, and ethical business practices.

Navigating Geopolitical Uncertainty:

The global political landscape remains volatile, with trade tensions, geopolitical conflicts, and economic sanctions impacting markets. Investors need to be aware of these risks and adjust their strategies accordingly.

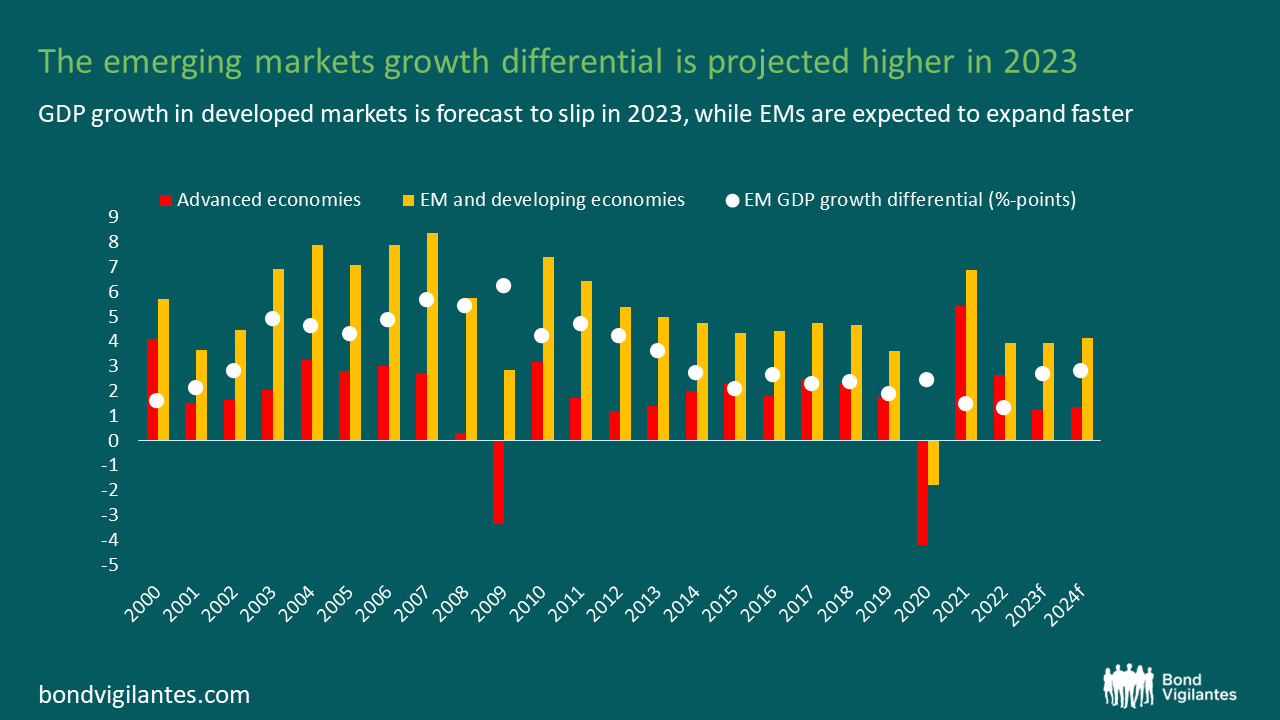

- Regional Diversification: Diversifying investment portfolios across different regions can mitigate risks associated with political instability in specific countries. Emerging markets, particularly in Asia and Africa, offer growth potential, but also present increased volatility.

- Currency Fluctuations: Currency fluctuations can significantly impact investment returns. Investors need to consider the impact of exchange rates on their investments and potentially hedge against currency risks.

- Supply Chain Resilience: Disruptions to global supply chains caused by geopolitical events and natural disasters are becoming more frequent. Companies with resilient supply chains, diversified sourcing, and robust risk management practices are better positioned to weather these challenges.

The Rise of the Individual Investor:

The rise of online brokerage platforms and access to financial information has empowered individual investors. This trend is likely to continue, with more people participating in the stock market.

- Active vs. Passive Investing: Individual investors are increasingly choosing active investment strategies, seeking to outperform the market by identifying undervalued stocks and timing their trades. However, passive investing, through index funds and ETFs, remains a popular choice for long-term growth and diversification.

- Retail Trading Platforms: Platforms like Robinhood and Webull have made stock trading accessible to a wider audience. This increased participation can lead to market volatility and potentially create speculative bubbles.

- Financial Literacy: The rise of individual investors highlights the importance of financial literacy. Investors need to understand basic investment concepts, risk management, and the importance of long-term investing to make informed decisions.

Emerging Trends to Watch:

- The Future of Work: The rise of automation and remote work is transforming the labor market. Companies developing technologies for remote collaboration, workforce management, and upskilling programs are likely to see increased investment.

- Healthcare Innovation: Advancements in biotechnology, personalized medicine, and telemedicine are driving innovation in the healthcare sector. Companies involved in drug development, medical device manufacturing, and digital health solutions are attracting investor interest.

- Space Exploration: The private space industry is booming, with companies like SpaceX and Blue Origin pushing the boundaries of space exploration. Investing in companies involved in space tourism, satellite technology, and space-based research could be a high-risk, high-reward proposition.

Conclusion:

The stock market in 2025 is a dynamic landscape shaped by technological advancements, societal shifts, and global challenges. Investors need to stay informed about key trends, understand the risks and opportunities presented by different sectors, and adapt their strategies to navigate this evolving environment. By focusing on sustainable investing, embracing technological innovation, and navigating geopolitical uncertainty, investors can position themselves for success in this exciting and unpredictable market.

Remember, investing involves inherent risks, and past performance is not indicative of future results. It is crucial to conduct thorough research, consult with a financial advisor, and invest based on your individual risk tolerance and financial goals.

Disclaimer: This article is for informational purposes only and should not be considered investment advice. It is essential to consult with a qualified financial advisor before making any investment decisions.