Navigating The Shifting Sands: Building Material Price Trends In 2025-2026

Navigating the Shifting Sands: Building Material Price Trends in 2025-2026

The construction industry, a cornerstone of economic growth, is perpetually navigating the fluctuating landscape of building material prices. The years 2025 and 2026 promise to be no different, presenting both challenges and opportunities for stakeholders. While the future is inherently uncertain, understanding the driving forces behind price fluctuations and emerging trends can equip industry players with valuable insights for strategic decision-making.

The Macroeconomic Undercurrent:

Several global economic factors will influence building material prices in the coming years:

- Inflation and Interest Rates: The global economic landscape is grappling with persistent inflation, driven by supply chain disruptions, geopolitical tensions, and rising energy costs. Central banks around the world are raising interest rates to combat inflation, impacting borrowing costs for construction projects. This interplay between inflation and interest rates will significantly impact the cost of building materials.

- Global Economic Growth: The pace of global economic growth will influence demand for construction projects. A robust global economy generally translates to higher demand for building materials, driving up prices. Conversely, a slowdown in economic activity could lead to a decline in demand and potentially lower prices.

- Geopolitical Landscape: Geopolitical tensions, such as the ongoing Russia-Ukraine conflict, can disrupt global supply chains and trigger volatility in commodity markets. This can lead to price fluctuations for materials sourced from affected regions.

Specific Material Trends:

1. Lumber:

- Supply and Demand Dynamics: The lumber market is highly sensitive to fluctuations in housing starts and demand for new construction. While supply chain bottlenecks and labor shortages have eased somewhat, the demand for lumber remains strong, particularly in the residential sector.

- Price Outlook: Lumber prices are expected to remain relatively stable in the short term, with potential for moderate increases driven by ongoing demand and potential supply constraints. However, long-term price projections are uncertain, influenced by factors like interest rates and housing market trends.

2. Concrete:

- Key Drivers: The price of concrete is influenced by the cost of its key ingredients: cement, aggregates, and water. Cement production is energy-intensive, making it susceptible to fluctuations in energy prices.

- Price Outlook: Concrete prices are expected to rise moderately in the coming years due to rising energy costs and potential increases in demand driven by infrastructure projects. However, the pace of price increases will depend on the availability of raw materials and the overall economic climate.

3. Steel:

- Supply and Demand Balance: Global steel production is facing challenges from rising energy prices and supply chain disruptions. The demand for steel remains strong, particularly in infrastructure projects and manufacturing sectors.

- Price Outlook: Steel prices are expected to remain elevated in the near term due to tight supply and strong demand. However, the long-term outlook is more uncertain, influenced by factors like government policies, technological advancements, and the overall economic environment.

4. Copper:

- Demand Drivers: Copper is a crucial component in electrical wiring, plumbing, and construction materials. The increasing demand for renewable energy technologies, electric vehicles, and infrastructure projects is driving demand for copper.

- Price Outlook: Copper prices are expected to remain elevated in the coming years, driven by strong demand and potential supply constraints. However, the price trajectory is sensitive to global economic conditions and the pace of technological advancements.

5. Aluminum:

- Global Supply and Demand: Aluminum production is energy-intensive, making it vulnerable to fluctuations in energy prices. Global demand for aluminum is driven by its use in construction, transportation, and packaging industries.

- Price Outlook: Aluminum prices are expected to fluctuate in the coming years, influenced by energy costs, global economic growth, and the demand for aluminum in various industries.

6. Plastics:

- Petrochemical Link: The price of plastics is heavily dependent on the price of oil, its primary raw material. Fluctuations in oil prices will directly impact plastic prices.

- Price Outlook: Plastic prices are expected to remain volatile in the coming years, influenced by oil prices, global economic conditions, and the adoption of sustainable alternatives.

7. Insulation:

- Energy Efficiency Focus: Insulation materials are crucial for energy efficiency in buildings. Growing concerns about climate change and rising energy costs are driving demand for insulation.

- Price Outlook: Insulation prices are expected to remain relatively stable in the short term, with potential for moderate increases driven by rising energy costs and the growing demand for energy-efficient solutions.

8. Roofing Materials:

- Demand and Supply: The demand for roofing materials is tied to the construction sector. Supply chain disruptions and labor shortages have impacted the availability of roofing materials.

- Price Outlook: Roofing material prices are expected to remain elevated in the near term due to supply constraints and strong demand. However, the long-term outlook depends on factors like the availability of raw materials and the overall economic environment.

Emerging Trends:

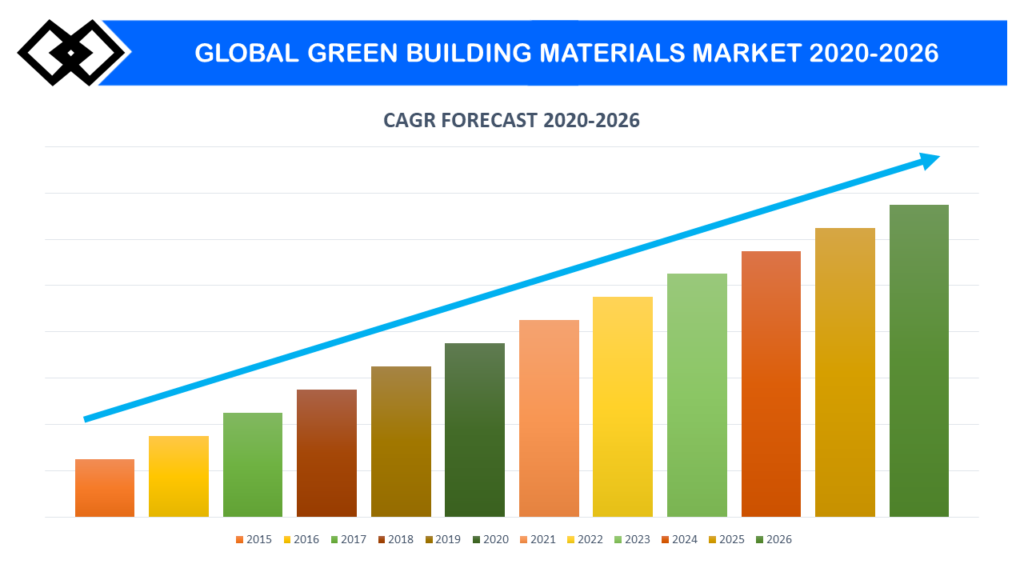

- Sustainable Building Materials: The construction industry is increasingly embracing sustainable building materials, driven by environmental concerns and government regulations. This trend is expected to gain momentum in the coming years, leading to increased demand for materials like bamboo, recycled plastics, and bio-based composites.

- Technological Advancements: Advancements in construction technology are transforming the industry. The use of prefabricated components, 3D printing, and robotics is expected to impact building material demand and pricing.

- Circular Economy: The concept of a circular economy, where materials are reused and recycled, is gaining traction in the construction sector. This trend could lead to a shift in demand for recycled materials and a decrease in the reliance on virgin resources.

Challenges and Opportunities:

- Supply Chain Volatility: The global supply chain remains vulnerable to disruptions, potentially leading to price fluctuations and material shortages.

- Labor Shortages: The construction industry continues to face labor shortages, potentially impacting project timelines and increasing labor costs.

- Rising Energy Costs: The rising cost of energy, particularly for energy-intensive materials like cement and aluminum, will contribute to price increases.

- Technological Disruption: The adoption of new construction technologies could lead to changes in material demand and pricing.

Navigating the Future:

- Strategic Procurement: Construction companies need to develop robust procurement strategies that mitigate risks associated with price fluctuations and material shortages.

- Diversification of Suppliers: Diversifying suppliers can reduce dependence on a single source and mitigate supply chain disruptions.

- Early Planning: Planning projects well in advance allows for better budgeting and material sourcing.

- Innovation and Sustainability: Embracing sustainable building materials and innovative construction technologies can reduce costs and environmental impact.

Conclusion:

The building material price landscape in 2025-2026 will be shaped by a complex interplay of macroeconomic factors, global supply and demand dynamics, and emerging trends. Construction stakeholders need to stay informed about these forces and adapt their strategies accordingly. By understanding the drivers of price fluctuations, embracing sustainable solutions, and navigating technological advancements, the industry can navigate the shifting sands of building material prices and ensure project success.