Lumber Prices In 2025: Navigating The Uncertain Future

Lumber Prices in 2025: Navigating the Uncertain Future

The lumber market, a cornerstone of construction and a reflection of broader economic trends, has experienced a rollercoaster ride in recent years. From the dizzying highs of 2021 to the subsequent decline, the question on everyone’s mind is: what does the future hold for lumber prices in 2025?

Predicting future market trends is inherently challenging, especially in an industry as complex and influenced by numerous factors as lumber. However, by analyzing historical data, current market dynamics, and potential future scenarios, we can gain valuable insights into the potential trajectory of lumber prices in the coming years.

The Recent Rollercoaster:

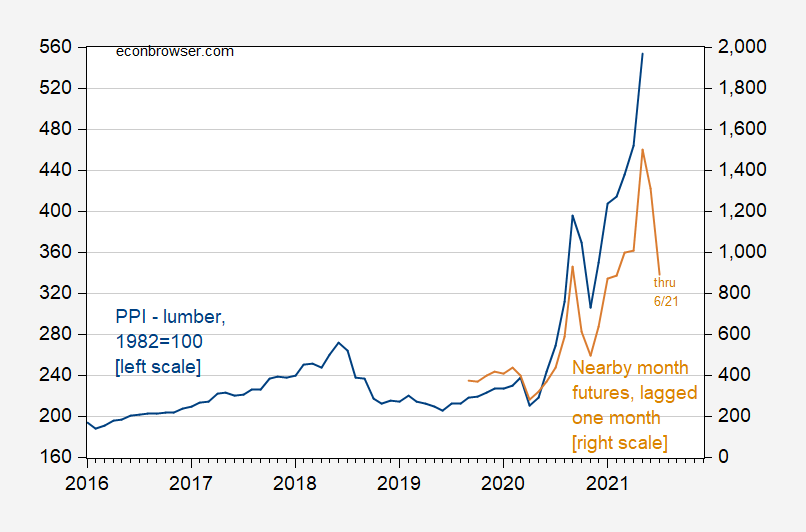

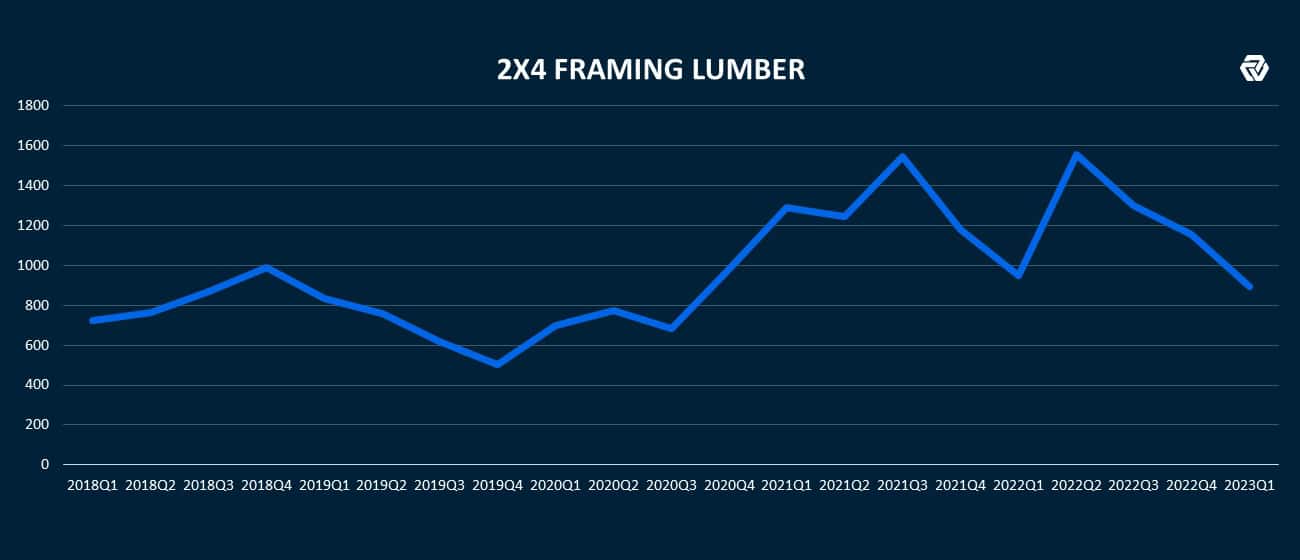

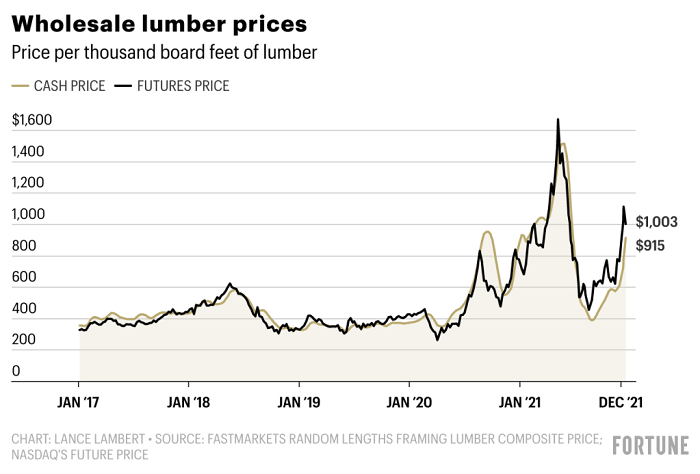

The past few years have witnessed a dramatic shift in lumber prices. The COVID-19 pandemic triggered a surge in demand as homeowners embarked on renovation projects and the housing market boomed. This, coupled with supply chain disruptions and mill closures, propelled prices to record highs in 2021.

The subsequent decline, starting in the latter half of 2021, can be attributed to several factors:

- Easing of Demand: As pandemic-related construction projects waned and interest rates rose, the housing market cooled, leading to a decrease in demand for lumber.

- Increased Supply: Mill closures began to reverse, and the lumber industry ramped up production, leading to an increase in supply.

- Inventory Build-up: Builders and retailers built up inventories during the price spike, leading to a reduction in purchases.

Key Factors Shaping Lumber Prices in 2025:

While the recent volatility has subsided, several factors will continue to shape the lumber market in the coming years:

1. Housing Market Dynamics:

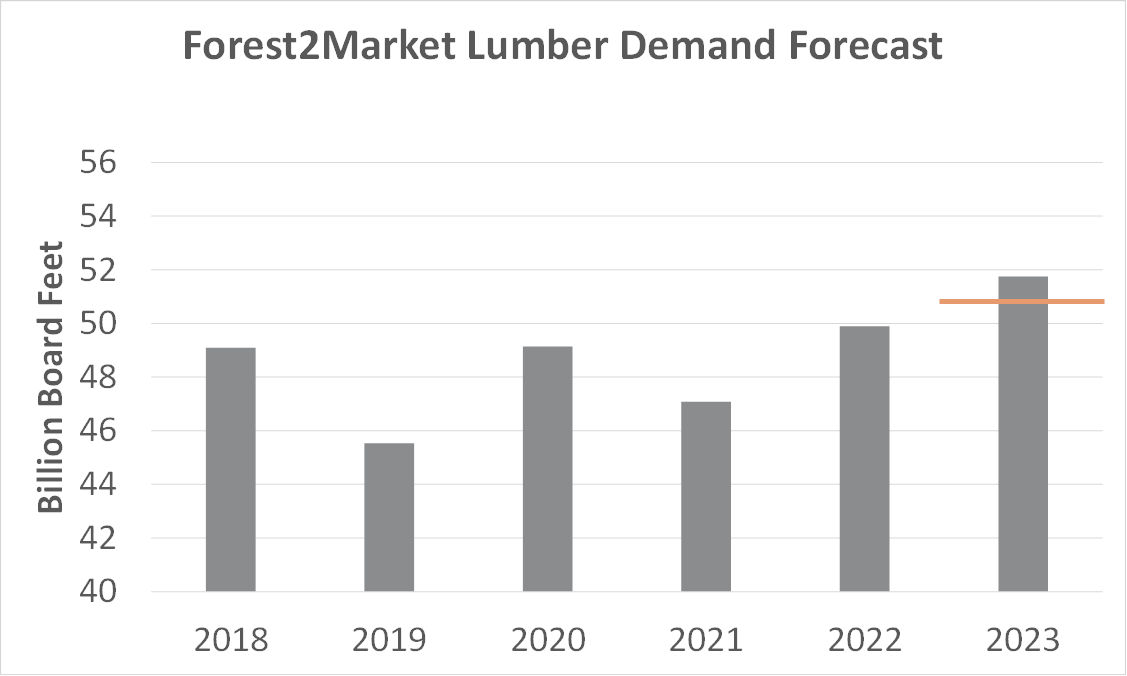

The housing market remains a crucial driver of lumber demand. Factors like interest rates, affordability, and demographic trends will significantly impact new construction and renovation activities, influencing lumber prices.

2. Interest Rates and Economic Growth:

Rising interest rates can dampen housing demand and construction activity, leading to lower lumber prices. Conversely, robust economic growth and low interest rates can boost demand and drive prices upward.

3. Supply Chain Resilience:

The lumber industry’s ability to navigate supply chain disruptions and maintain consistent production will play a critical role in price stability. Factors like labor shortages, transportation challenges, and raw material availability will impact supply and, consequently, prices.

4. Technological Advancements:

Innovations in forestry management, harvesting techniques, and lumber processing can lead to increased efficiency and potentially lower prices. However, the adoption of these technologies will depend on factors like cost, accessibility, and market acceptance.

5. Environmental Regulations and Sustainability:

Growing concerns about deforestation and climate change are driving stricter environmental regulations. These regulations can impact lumber production, potentially leading to higher prices. However, they can also encourage sustainable practices and incentivize the use of alternative building materials.

6. Global Lumber Trade:

The global lumber market is interconnected, with imports and exports playing a significant role in price fluctuations. Factors like trade agreements, tariffs, and global economic conditions can influence lumber prices in specific regions.

Potential Scenarios for 2025:

Based on the factors discussed above, several potential scenarios for lumber prices in 2025 can be envisioned:

Scenario 1: Moderate Growth and Stability:

This scenario assumes a gradual recovery in the housing market, driven by stable economic growth and moderate interest rates. Increased supply and improved supply chain efficiency contribute to price stability, with lumber prices gradually increasing to a level slightly higher than current levels.

Scenario 2: Continued Decline and Volatility:

This scenario assumes a prolonged downturn in the housing market due to factors like rising interest rates, economic uncertainty, and affordability concerns. Reduced demand and oversupply lead to further price declines, with potential volatility as the market adjusts to new equilibrium levels.

Scenario 3: Sustainable Growth and Price Moderation:

This scenario assumes a shift towards sustainable forestry practices and increased adoption of innovative technologies. While demand remains strong, supply increases due to efficient production and alternative materials, leading to moderate price growth and greater stability.

Navigating the Uncertainties:

While these scenarios offer potential insights, the actual trajectory of lumber prices in 2025 will be influenced by a complex interplay of factors. To navigate this uncertainty, stakeholders in the lumber market need to:

- Monitor Market Trends: Closely track housing market data, interest rates, economic indicators, and lumber industry news to identify emerging trends.

- Manage Inventory: Balance inventory levels to avoid overstocking or shortages, mitigating the impact of price fluctuations.

- Diversify Materials: Explore alternative building materials and construction methods to reduce reliance on lumber and mitigate price risks.

- Invest in Technology: Embrace innovative technologies to enhance efficiency, reduce costs, and improve sustainability.

- Advocate for Sustainable Practices: Support policies and initiatives that promote sustainable forestry and responsible lumber sourcing.

Conclusion:

Predicting lumber prices in 2025 is a complex endeavor, with numerous factors influencing market dynamics. While uncertainty remains, understanding the key drivers and potential scenarios can help stakeholders navigate the evolving landscape. By adapting to changing market conditions, embracing technological advancements, and prioritizing sustainability, the lumber industry can position itself for a more stable and resilient future.