Crypto Currency Trends 2025: A Look Into The Future Of Digital Assets

Crypto Currency Trends 2025: A Look into the Future of Digital Assets

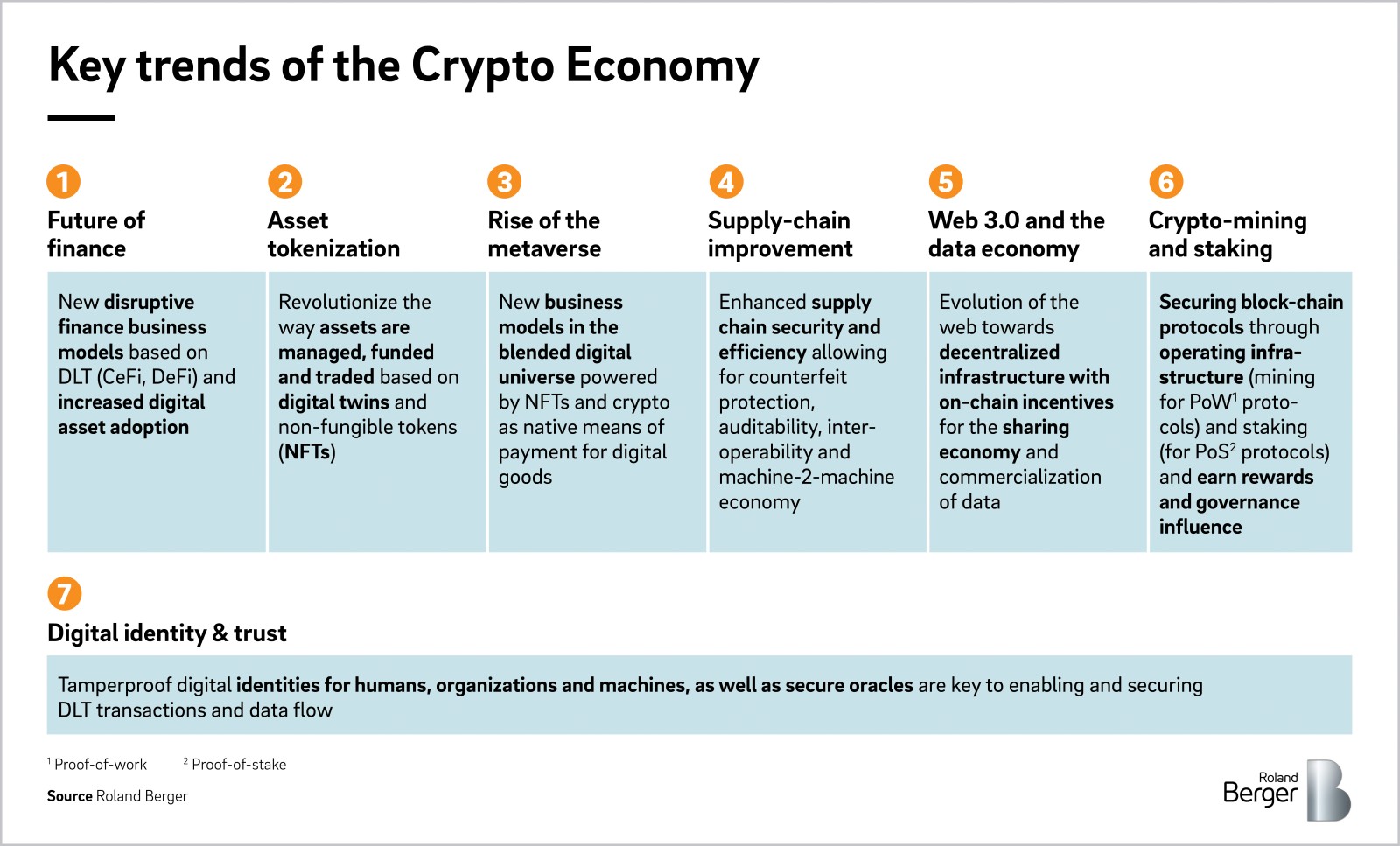

The year 2025 is just around the corner, and the crypto landscape is evolving at a breakneck pace. As we stand on the cusp of this new era, it’s crucial to understand the trends shaping the future of digital assets. From regulatory frameworks to emerging technologies, 2025 promises a dynamic and potentially transformative year for cryptocurrencies.

1. Regulatory Clarity and Adoption:

The year 2025 will likely see a significant shift in regulatory landscapes globally. Governments and financial institutions are grappling with the complexities of cryptocurrencies, and we can expect more concrete regulations to emerge.

- Global Regulatory Frameworks: Expect the development of comprehensive regulatory frameworks for cryptocurrencies, similar to the MiCA (Markets in Crypto-Assets) framework in Europe. These frameworks will likely cover areas like consumer protection, anti-money laundering (AML), and Know Your Customer (KYC) regulations.

- Institutional Adoption: Increased regulatory clarity will likely lead to greater institutional adoption of cryptocurrencies. Traditional financial institutions, including banks and hedge funds, will likely explore ways to incorporate crypto into their investment strategies, potentially leading to increased liquidity and stability in the market.

- Central Bank Digital Currencies (CBDCs): Several countries are exploring the development of CBDCs, which could potentially reshape the financial landscape. The potential for CBDCs to co-exist with existing cryptocurrencies and their impact on the broader financial system will be a key area to watch.

2. Decentralized Finance (DeFi) and Web3:

Decentralized Finance (DeFi) continues to be a major driver of innovation within the crypto space. In 2025, we can expect DeFi to become more mainstream, with several trends shaping its trajectory:

- Interoperability and Composability: DeFi protocols will become more interoperable, allowing users to seamlessly move assets and utilize various DeFi services across different platforms. This increased composability will lead to the emergence of innovative DeFi applications and ecosystems.

- Real-World Applications: DeFi will move beyond speculation and find its footing in real-world applications. Expect to see more DeFi solutions for lending, borrowing, insurance, and even traditional financial services like mortgages and asset management.

- Web3 Integration: DeFi will be tightly integrated with Web3, a decentralized internet powered by blockchain technology. This integration will pave the way for new user experiences, including decentralized social media, gaming platforms, and content creation tools.

3. The Rise of Layer-2 Scaling Solutions:

Scalability remains a critical challenge for blockchain networks, particularly for those like Ethereum that experience high transaction fees and congestion during peak periods. In 2025, we expect to see the widespread adoption of Layer-2 scaling solutions:

- Optimistic Rollups: These solutions process transactions off-chain and then submit them to the main chain for verification, offering faster and cheaper transactions while maintaining security.

- Zero-Knowledge Proofs: This technology allows for the verification of transactions without revealing sensitive information, potentially enabling faster and more private transactions.

- Sharding: This technique divides the blockchain into smaller shards, distributing the workload and improving scalability.

These scaling solutions will significantly improve the user experience and open the door for wider adoption of blockchain technology.

4. Metaverse and NFTs:

The metaverse, a virtual world where users can interact and engage with each other, is another area where cryptocurrencies are playing a significant role.

- NFT Utility: Non-fungible tokens (NFTs) will likely play a critical role in the metaverse, allowing users to own and trade digital assets like virtual land, avatars, and in-game items.

- Decentralized Gaming: The metaverse will foster the growth of decentralized gaming platforms, where players can own and control their in-game assets and participate in the game’s governance.

- Digital Identity and Ownership: NFTs will also be used to create secure and verifiable digital identities, allowing users to control their personal data and participate in decentralized applications.

5. Sustainability and Environmental Concerns:

The environmental impact of cryptocurrencies has become a major concern. In 2025, expect to see significant progress in addressing these concerns:

- Proof-of-Stake (PoS) Consensus: PoS-based blockchains consume significantly less energy than Proof-of-Work (PoW) blockchains, which rely on energy-intensive mining processes. The transition to PoS will be a critical step towards making cryptocurrencies more sustainable.

- Energy-Efficient Mining Techniques: Innovations in mining hardware and software will lead to more energy-efficient mining operations.

- Carbon Offsetting and Renewable Energy Sources: Cryptocurrency projects will increasingly invest in carbon offsetting programs and utilize renewable energy sources to mitigate their environmental impact.

6. The Rise of Privacy Coins:

Privacy coins like Monero and Zcash have gained traction due to their focus on user privacy and anonymity. In 2025, we can expect this trend to continue:

- Increased Adoption: Privacy coins will likely see increased adoption as users become more aware of data privacy concerns and the potential for censorship in traditional financial systems.

- Regulatory Challenges: Regulators will likely face challenges in balancing privacy concerns with the need to prevent illicit activities using privacy coins.

- Innovation in Privacy Technologies: Expect to see advancements in privacy-enhancing technologies, such as zero-knowledge proofs and homomorphic encryption, which will further enhance the privacy of transactions.

7. The Future of Bitcoin:

Bitcoin, the first and most well-known cryptocurrency, will continue to play a significant role in the crypto ecosystem in 2025.

- Store of Value: Bitcoin’s limited supply and decentralized nature will continue to make it a compelling asset for investors seeking a hedge against inflation and other economic uncertainties.

- Adoption as a Payment Method: Bitcoin’s adoption as a payment method may see a gradual increase, particularly in emerging markets where traditional financial systems are less developed.

- Competition from Other Cryptocurrencies: Bitcoin will face increasing competition from other cryptocurrencies, particularly those with faster transaction speeds and lower fees.

8. Cross-Border Payments and Remittances:

Cryptocurrencies have the potential to revolutionize cross-border payments and remittances. In 2025, we can expect to see:

- Increased Efficiency and Speed: Cryptocurrency-based payment systems can facilitate faster and more efficient cross-border payments, reducing transaction fees and delays.

- Lower Costs: Cryptocurrency-based remittances can offer lower costs compared to traditional financial institutions, benefiting individuals and businesses sending money across borders.

- Financial Inclusion: Cryptocurrencies can provide access to financial services for individuals and businesses in underserved regions, promoting financial inclusion.

9. The Role of DAOs:

Decentralized Autonomous Organizations (DAOs) are blockchain-based organizations that operate autonomously, without a central authority. In 2025, DAOs will likely become more prevalent:

- Governance and Decision-Making: DAOs will play a more significant role in governance and decision-making processes, allowing for transparent and decentralized governance.

- Fundraising and Investment: DAOs will continue to be used for fundraising and investment purposes, enabling the creation of decentralized ventures and projects.

- Community-Driven Development: DAOs will foster community-driven development, allowing individuals to participate in the creation and governance of decentralized projects.

10. Artificial Intelligence (AI) and Crypto:

The integration of AI and crypto will likely lead to significant advancements in 2025:

- Automated Trading: AI-powered trading bots can analyze market data and execute trades automatically, potentially improving efficiency and profitability.

- Fraud Detection and Security: AI can be used to detect and prevent fraudulent activities in the crypto space, enhancing security and trust.

- Personalized Financial Services: AI can personalize financial services based on individual preferences and risk profiles, offering tailored solutions for crypto investors.

Challenges and Considerations:

While 2025 promises exciting developments in the crypto space, several challenges and considerations remain:

- Volatility and Market Manipulation: The cryptocurrency market remains highly volatile and susceptible to manipulation. Regulators and market participants must work together to mitigate these risks.

- Security and Privacy Concerns: Cryptocurrency transactions are inherently public, raising concerns about user privacy and security. Advanced security measures and privacy-enhancing technologies are crucial to address these concerns.

- Scalability and Interoperability: Scaling blockchain networks and ensuring interoperability between different platforms are ongoing challenges that need to be addressed.

- Regulation and Compliance: Navigating the evolving regulatory landscape and ensuring compliance with evolving regulations will be critical for the long-term growth and sustainability of the crypto industry.

Conclusion:

The year 2025 is poised to be a pivotal year for cryptocurrencies, with significant advancements in technology, regulation, and adoption. From DeFi and Web3 to the metaverse and NFTs, the crypto space is brimming with innovative applications and use cases. While challenges remain, the future of cryptocurrencies looks bright, with the potential to transform the financial landscape and empower individuals and businesses worldwide. By staying informed about the latest trends and developments, we can navigate this exciting and dynamic landscape and prepare for the transformative impact of cryptocurrencies on the future.